I retired in 2014 and no longer work or have (earned income) Just Military retirement and VA Disability , So I can no longer contribute to the Roth IRA which was in TSP C fund. We were able to max it out for about 9 years. No 401k either since i no longer have earned income so IRA will just sit in TSP since i can not contribute. So in 2014 I invested in USAA mutual fund "Cornerstone fund. Then in 2019 USAA sold it to Victory Capital. ER went up considerably from USAA ER of 0.27 to Victory Capital who raised ER to 1.14. That was final straw for me .Also could never reach anyone at victory by phone and they never responded to e mail. I had heard good things about Vanguard and Fidelity and Schwab, since I could never reach anyone at Victory I decided to called Vanguard they were busy but agreed to call me back within 1 hour.. they did and I let them deal with Victory capital and transfer the fund to Vanguard. It took about 10 business days. Now I have a nice 3 fund portfolio with Vanguard (admiral funds) and they have low ER of 0.04how many of you are cleaning up and filling your ira and 401k's etc before end of year? i dont trust this market very much right now i have been recovering my losses slowly and slowly getting out of individual stock and selling off shares of mutual funds etc. i want to take a different approach next year hopefully all this election fiasco will be over and the economy can try to recover from this past year of doom. if that is the case i want to follow the s&p, nasdaq and russell 2000. will most likely pick up mutual funds that track the following nasdaq and russell 2000...i am already in a s&p 500 fund.

for now i am watching this market close out the 2020 calendar year and have most all my ira's parked in the money market cash reserves.. if anyone cares to share their investment strategy for 2021 and on i'd be interested in hearing so. happy holidays and god bless all.. if your faith is elsewhere, many blessings to those who believe differently.

My dad used to always listen to a radio show called "Money Talk"with Bob Brinker and he often said that the S&P 500 stocks were a good option so Vanguard total stock market fund is about 99% vested in S&P 500. Bob Brinker always talked about hitting "critical mass" with investing which means you get 1 million in investments . Wife and I will likely never hit critical mass, since we started sort of late, but expect to make some decent gains and when we eventually tap into it for income it will be what it is at that time - or +.

60% Vanguard Total Stock Market Index Fund

20% Vanguard Total International Stock Index Fund

20% Vanguard Total Bond Market Index Fund

Investment strategy is simple for us now We use a Vanguard 3fund portfolio and add to it every month . It is also a strategy that Vangurds founder Jack Bogle inspired. Several interesting books about Boglehead investment strategy and the 2, 3 ,4 and 5 fund portfolios. I do not own any individual stocks, i just like mutual funds put the $$ in and leave it alone and it does what it does for better or worse.

Currently wife and can put in about $500 per month in this fund and in about 3 years when our house is paid off and no longer have a mortgage we aim to contribute the former mortgage payment which is right now $725 probably more like $500 a month because we will have to consider property tax. Full SS age for me is age 67 if I claim SS at early age of 62 SS check would be about 1500, waiting to 67 would push it up some just over 2k as I recall, I will Probably claim SS retirement at 62 and dump most of that into the fund as well.

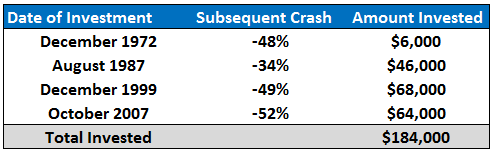

I think funds with S&P 500 are usually going to do well long term though one might have to ride out some rough seas from time to time. 2008 comes to mind. My TSP IRA took a big punch that year and never fully recovered till about 2013.

Daughter is 20 and just started an IRA with Fidelity and they have zero ER fees which is nice for young investers.