You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Elon Musk #2

- Thread starter JeffKeryk

- Start date

- Status

- Not open for further replies.

Me too, Son gave me H3LL for riding it to the bottom. Will never happen again.Like what happened with my GM stock.

What current S&P 500 stock is grounded in reality?I understand that. I'm not looking at market cap, I'm looking at how much they actually produce. Frankly, I don't think Tesla's stock is grounded in reality, so I look at production instead. I say that as an investor in Tesla. By every other marker, VAG (and the others listed) are much, much bigger.

What current S&P 500 stock is grounded in reality?

They are there.

Elon has another problem. He is whacky again.

www.cnet.com

www.cnet.com

SpaceX's next Starship prototype, SN9, is leaning awkwardly inside its hangar

You OK there, SN9?

We are approaching a tipping point where BEV and or H2 vehicles become more cost efficient that IC tech. Tesla stock price anticipates that point. The big hurdle will be the distribution infrastructure to deliver all the extra power to the end users. If just 10% of a city plugs in to charge in the evening, this can overload the extra capacity of the grid. Right now Tesla has poor reliability, of parts not related to the electrification. This will hopefully get fixed soon.

It has been my observation that emissions controlled trucks have much higher maintenance costs and worse efficiency than the older trucks. Just DPF filter cleaning or replacement and DEF cost for example. The same is true for some of the gasoline efficiency changes. The cost of MPG gains exceeds the value of the fuel saved, case in point: Cylinder deactivation causing rebuilds (granted this was VERY poorly engineered). Extra rebuild cost for CVT or 8+speed transmissions

It has been my observation that emissions controlled trucks have much higher maintenance costs and worse efficiency than the older trucks. Just DPF filter cleaning or replacement and DEF cost for example. The same is true for some of the gasoline efficiency changes. The cost of MPG gains exceeds the value of the fuel saved, case in point: Cylinder deactivation causing rebuilds (granted this was VERY poorly engineered). Extra rebuild cost for CVT or 8+speed transmissions

I wonder what the stab-in-the-back legend will be made from. It all probably will have begun with the China Voltaics, then some solar roof saturation ceilings gathered pace in holding narrators down, disruptive long Greta and the Lithium could have caught a cold and the Cybertruck turn out to be forever ten years ahead of the DeLorean...

Absolutely need to know the next narrative after ludicrous mode – whack & tech are fundamentally precarious and won't reproduce but on a next level built up. Where to invest?

It won't take e-mobility a hundred years to correct viscosities and run into ceilings. Boring efficiency of transition actually is key by now (for all but poor Chrysler or so) – and of course a bit of embargoed battery breakthrough from Toyota et al.

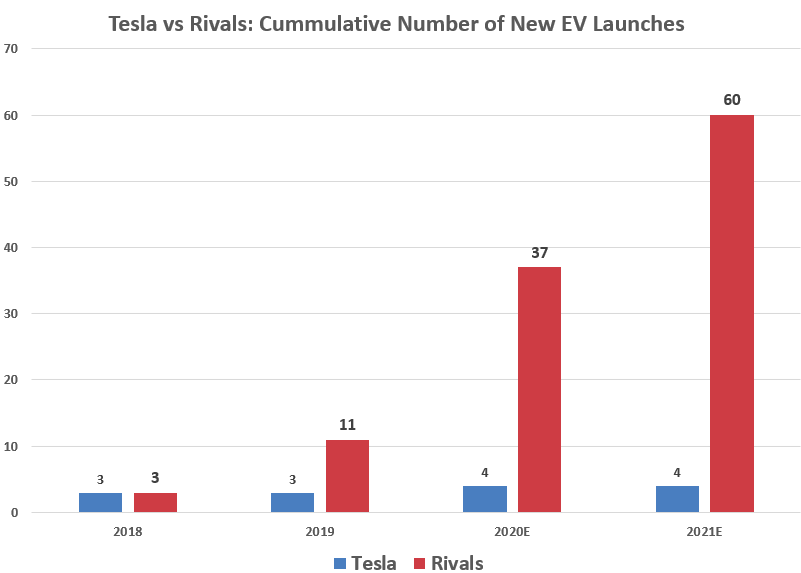

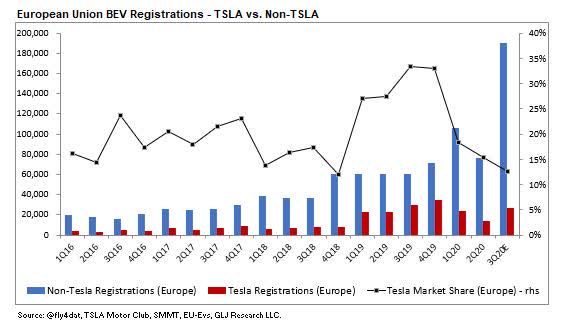

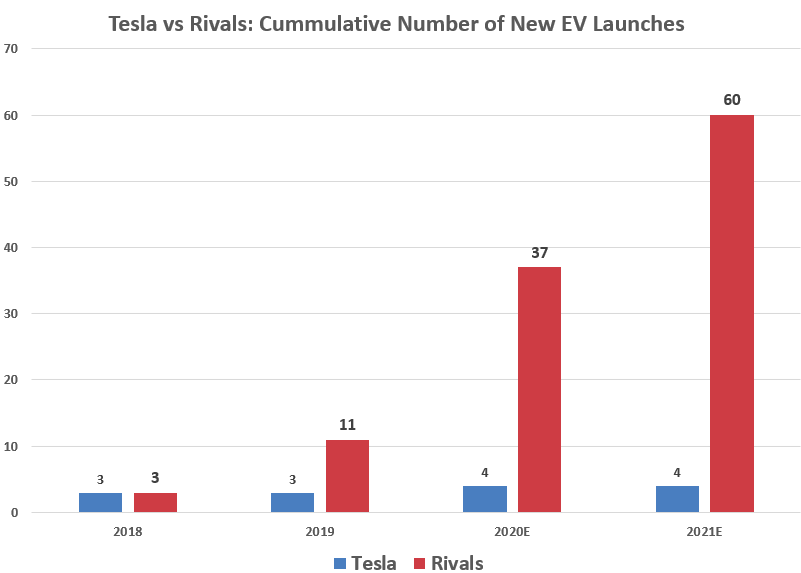

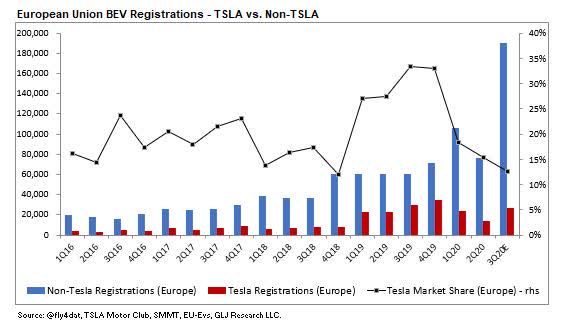

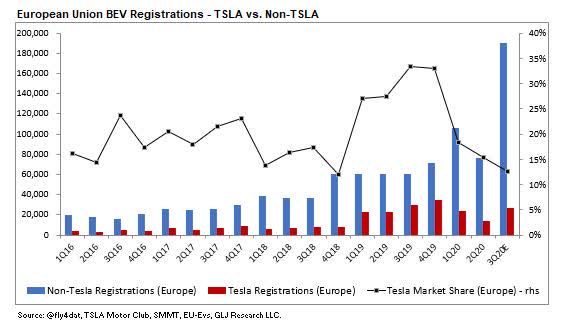

Growth and market share beyond the S&P 500 day and ludicrous narrative: https://seekingalpha.com/article/4394936-tesla-new-wave-of-competitors-threatens-ev-dominance

Nothing compares to a good stab-in-the-back legend.

Absolutely need to know the next narrative after ludicrous mode – whack & tech are fundamentally precarious and won't reproduce but on a next level built up. Where to invest?

It won't take e-mobility a hundred years to correct viscosities and run into ceilings. Boring efficiency of transition actually is key by now (for all but poor Chrysler or so) – and of course a bit of embargoed battery breakthrough from Toyota et al.

Growth and market share beyond the S&P 500 day and ludicrous narrative: https://seekingalpha.com/article/4394936-tesla-new-wave-of-competitors-threatens-ev-dominance

Nothing compares to a good stab-in-the-back legend.

Last edited:

JeffKeryk

Thread starter

Why do you think Tesla is building Giga Berlin?I wonder what the stab-in-the-back legend will be made from. It all probably will have begun with the China Voltaics, then some solar roof saturation ceilings gathered pace in holding narrators down, disruptive long Greta and the Lithium could have caught a cold and the Cybertruck turn out to be forever ten years ahead of the DeLorean...

Absolutely need to know the next narrative after ludicrous mode – whack & tech are fundamentally precarious and won't reproduce but on a next level built up. Where to invest?

It won't take e-mobility a hundred years to correct viscosities and run into ceilings. Boring efficiency of transition actually is key by now (for all but poor Chrysler or so) – and of course a bit of embargoed battery breakthrough from Toyota et al.

Growth and market share beyond the S&P 500 day and ludicrous narrative: https://seekingalpha.com/article/4394936-tesla-new-wave-of-competitors-threatens-ev-dominance

Nothing compares to a good stab-in-the-back legend.

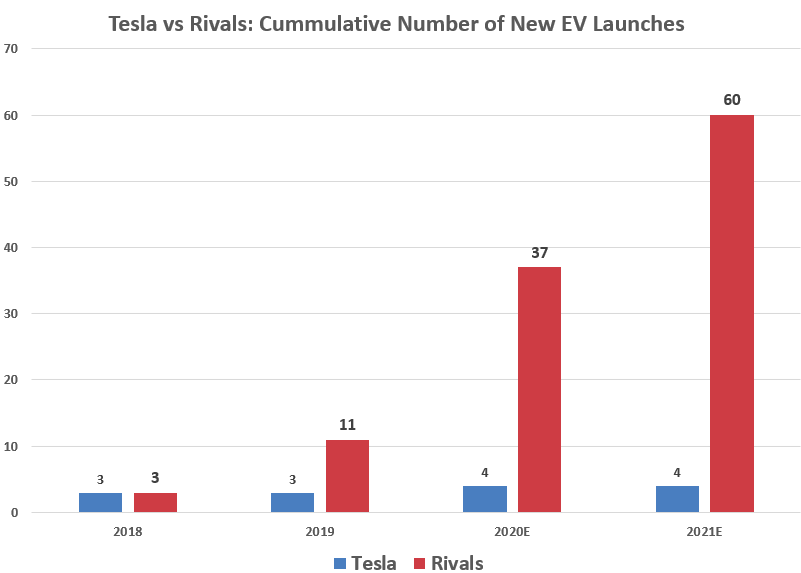

For such a handful of models most probably. Not 60, 120, 240 or 480.

Not for their dwindling solar roofing either, just their ordinary automotive automobiles. For as long as they can keep up.

You're the one seeing the Transformer MUSK formerly known as TSLA having other things going on there, needn't you?

Certainly appreciable if some Tesla or Musk would be looking into reasonable fashions of energy storage e.g., but the actual disruptives

were always diesel gate and PM2.5, climate crisis and lean production, Xbox and the Playstation, Lithium and Greta more than Tesla and

Elon, you know? My expectations for Berlin are low.

Not for their dwindling solar roofing either, just their ordinary automotive automobiles. For as long as they can keep up.

You're the one seeing the Transformer MUSK formerly known as TSLA having other things going on there, needn't you?

Certainly appreciable if some Tesla or Musk would be looking into reasonable fashions of energy storage e.g., but the actual disruptives

were always diesel gate and PM2.5, climate crisis and lean production, Xbox and the Playstation, Lithium and Greta more than Tesla and

Elon, you know? My expectations for Berlin are low.

Last edited:

JeffKeryk

Thread starter

How have your Tesla expectations turned out so far?My expectations for Berlin are low.

Tesla has far exceeded pretty much all expectations, even the most lofty, right?

TSLA is @ $640 today, blowing away my expectations.

Didn't mean to comment on day's price but directly answer your question. They'll need Berlin for these 3s and 4s to even materialize, right? This future smaller Tesla you'd never care about plus all the rest of Berlin already got priced in regarding that decline in market share. Fantasy shares may go to the 780$ or your 1000 or higher but to 78.78 - 64.64 ultimately, who'd even care about the end of the day*?

Fantasies as such are fascinating enough. Your typical Tesla (pre-Texas era) needs two seconds from zero to sixty, has a range of a thousand miles from a 10kWh battery with a 1000kWh capacity rechargeable to 100% of its 100kWh within no time. Now these german teams (to be found as soon as the staff for Grünheide will have been hired) far from the valley are required to design a lean and mean eGolf competitor but at the same time expected to disrupt something somewhere, or did I get that wrong?

With GM it is Cadillac first, with Ford it seems to be Mustang first, but calling a first a Mustang in want of a more virile image than currently available from Lincoln cannot necessarily be interpreted as easy going. Manufacturers in general are mostly developing platforms, flexibility – and profits by the way. The General won't be one exception. E-GMP, Ultium, e-TNGA maybe to get the solid states out,... GM with Honda, Toyota with Subaru, ten, twenty, thirty, forty, fifty or more plus Rivians and Lucids plus China plus Europe.

*just an anglicism, we're generally telling ourselves. While we're there, quite a dose of US- or Valley- or Texas-centrism often seems to be the most solid foundation of piled up disinterest and fantasies of omnipotence compensating the market share not filling the envelope of market cap.

Beliefs and activism of course remain much less interesting than ...a good stab-in-the-back legend.

Fantasies as such are fascinating enough. Your typical Tesla (pre-Texas era) needs two seconds from zero to sixty, has a range of a thousand miles from a 10kWh battery with a 1000kWh capacity rechargeable to 100% of its 100kWh within no time. Now these german teams (to be found as soon as the staff for Grünheide will have been hired) far from the valley are required to design a lean and mean eGolf competitor but at the same time expected to disrupt something somewhere, or did I get that wrong?

With GM it is Cadillac first, with Ford it seems to be Mustang first, but calling a first a Mustang in want of a more virile image than currently available from Lincoln cannot necessarily be interpreted as easy going. Manufacturers in general are mostly developing platforms, flexibility – and profits by the way. The General won't be one exception. E-GMP, Ultium, e-TNGA maybe to get the solid states out,... GM with Honda, Toyota with Subaru, ten, twenty, thirty, forty, fifty or more plus Rivians and Lucids plus China plus Europe.

*just an anglicism, we're generally telling ourselves. While we're there, quite a dose of US- or Valley- or Texas-centrism often seems to be the most solid foundation of piled up disinterest and fantasies of omnipotence compensating the market share not filling the envelope of market cap.

Beliefs and activism of course remain much less interesting than ...a good stab-in-the-back legend.

Last edited:

The American automotive market is not the same as the one in EU, or China, or Japan, or Australia.

There are many areas in the world that diesel is the most popular fuel because of tax, and people stuck in traffic with diesel is the most damaging aspect of their air pollution problem (scooters with no emission control is another). Many of them are starting to ban diesel in those area (or at least restrict the amount they can emit).

So EV in a restricted area is a license to drive into downtown, you want to drive instead of taking subway and buses you need an EV. This works because they do not have the American lifestyle, of needing a car that commute 150 miles a day round trip just in case. They also typically don't need a car that can tow a boat, or crew cab, or a bed, or seats that fit 4 190-250 lb adults.

They also don't have a military that can discipline Iraq, Iran, Saudi, Libya, Venezuela, etc. So their commute fuel is actually a national security issues that we have been taken for granted in the US.

Will Model 3 works for Idaho potato farmers? Probably not for another 10 years. Will a Nissan Leaf works for someone commuting from suburb to downtown in a European city? Probably very well. Tesla might be able to build a Model 1 with a 80 mile range and sell for 1/2 the price of a Prius after some tax break.

There are many areas in the world that diesel is the most popular fuel because of tax, and people stuck in traffic with diesel is the most damaging aspect of their air pollution problem (scooters with no emission control is another). Many of them are starting to ban diesel in those area (or at least restrict the amount they can emit).

So EV in a restricted area is a license to drive into downtown, you want to drive instead of taking subway and buses you need an EV. This works because they do not have the American lifestyle, of needing a car that commute 150 miles a day round trip just in case. They also typically don't need a car that can tow a boat, or crew cab, or a bed, or seats that fit 4 190-250 lb adults.

They also don't have a military that can discipline Iraq, Iran, Saudi, Libya, Venezuela, etc. So their commute fuel is actually a national security issues that we have been taken for granted in the US.

Will Model 3 works for Idaho potato farmers? Probably not for another 10 years. Will a Nissan Leaf works for someone commuting from suburb to downtown in a European city? Probably very well. Tesla might be able to build a Model 1 with a 80 mile range and sell for 1/2 the price of a Prius after some tax break.

JeffKeryk

Thread starter

TSLA price was $86 Jan 1st. Today TSLA closed at $695.

If you bought 100 shares Jan 1st you would have paid $8,600.

Today it would be worth $695,000 on paper. You would have a wonderful tax problem on your hands...

If you bought 100 shares Jan 1st you would have paid $8,600.

Today it would be worth $695,000 on paper. You would have a wonderful tax problem on your hands...

TSLA price was $86 Jan 1st. Today TSLA closed at $695.

If you bought 100 shares Jan 1st you would have paid $8,600.

Today it would be worth $695,000 on paper. You would have a wonderful tax problem on your hands...

That’s just not even close to true.

JeffKeryk

Thread starter

You are right. I missed a decimal point.

$69,500.

I guess my point is, the believers have been beating the snot out of the naysayers all year long.

Last edited:

They're only getting shriller and shriller to find the poor souls meant to pay for the maximum (de)materialization and fundamental symmetry.

Always appreciate reading your ideas where the money would have to come from. Probably not enough to be had from your naysayers alone ;-)

Always appreciate reading your ideas where the money would have to come from. Probably not enough to be had from your naysayers alone ;-)

Last edited:

That pretty much goes for any reputable stock.TSLA price was $86 Jan 1st. Today TSLA closed at $695.

If you bought 100 shares Jan 1st you would have paid $8,600.

Today it would be worth $695,000 on paper. You would have a wonderful tax problem on your hands...

Heck, forget Tesla, if you bought Walmart in the early 70s with $5000 (300 shares) you would have 80 million dollars (620,000) shares today AND be collecting roughly 1.3 million a year in dividends. But that is just an example, more recent new comers, Netflix, Amazon, Roku, Apple and all the past boom and some bust tech stocks ya da ya da.

Telsa is speculation getting into the automotive business that is already saturated and even more so a vehicle with limited uses/range. Any manufacturer can produce what Telsa is. With that said, I am not against the company for a spec buy. Not for me and my point in life, but Tesla goes beyond cars, far more then I care to learn. Musk is a visionary, but wow, dont invest what you cant afford to lose. Right now, its a house of cards, unless you bought Jan of 2020, no saying it wont be back to 200 next year.

Tesla won't remain in the S&P 500 for long unless it continues to meet certain performance criteria. My guess is that Q4 2020 numbers will once again be favorable. Will that lead to another boost in the stock price around the middle of January when the numbers are announced ?

Maybe. And maybe the stock will stabilize around the $650 range with less volatility for a while. I'm fine with that. My cost basis per share is just over $42.

People continually fail to recognize that Tesla is more than just a manufacturer of automobiles for the retail market. If and when they get their robotaxi line out in the real world they are going to dominate that market. Add their sales of Tesla insurance, licensed software sales to other EV manufacturers, and sales of batteries to other manufacturers who are constrained for a number of reasons from ever entering the market with their own technology, and you have a company that can easily have a stock value of $1500 to $2000 per share by 2024.

Is it a Ponzi scheme ? Some would say that. It certainly has defied all "normal" logic. Or maybe I should say redefined.

Personally, I plan on selling a small portion of my holdings each year and using that cash for other purposes. If the stock skyrockets I'll still have plenty of value available to tap. If it plummets, due to the failing of Tesla or just due to a huge market dive, I'll still be just fine and won't worry about it.

If any manufacturer can produce what Tesla is, what are they waiting for ? Oh, maybe tens of billions of dollars for R&D, new manufacturing facilities, and other needed changes in how they make vehicles. Let's see how and when they can do that while Tesla is not standing still.

Maybe. And maybe the stock will stabilize around the $650 range with less volatility for a while. I'm fine with that. My cost basis per share is just over $42.

People continually fail to recognize that Tesla is more than just a manufacturer of automobiles for the retail market. If and when they get their robotaxi line out in the real world they are going to dominate that market. Add their sales of Tesla insurance, licensed software sales to other EV manufacturers, and sales of batteries to other manufacturers who are constrained for a number of reasons from ever entering the market with their own technology, and you have a company that can easily have a stock value of $1500 to $2000 per share by 2024.

Is it a Ponzi scheme ? Some would say that. It certainly has defied all "normal" logic. Or maybe I should say redefined.

Personally, I plan on selling a small portion of my holdings each year and using that cash for other purposes. If the stock skyrockets I'll still have plenty of value available to tap. If it plummets, due to the failing of Tesla or just due to a huge market dive, I'll still be just fine and won't worry about it.

If any manufacturer can produce what Tesla is, what are they waiting for ? Oh, maybe tens of billions of dollars for R&D, new manufacturing facilities, and other needed changes in how they make vehicles. Let's see how and when they can do that while Tesla is not standing still.

Every time I look at the Model 3P in my garage with few feet of snow outside, I fantasize about if only I had put that 75K in Tesla stock in Nov 2018. But then I tell myself, I would have never been that stupid to do it, so why think about it? I am watching Jeff's monthly (quarterly) Tesla topics for entertainment and feeling guilty but after getting burned crisply in 2000 on internet bubble, now I put my money on the market only. Yes I have missed out on all high flyers but I have not been burned by Nortel etc either.

My advice to the younger crowd here? Invest in the market with significant percentage of your paycheck every pay period and don't bother to look at it for decades. You will do OK.

My advice to the younger crowd here? Invest in the market with significant percentage of your paycheck every pay period and don't bother to look at it for decades. You will do OK.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 112

- Views

- 4K

- Replies

- 11

- Views

- 1K