- Joined

- Jun 8, 2022

- Messages

- 5,570

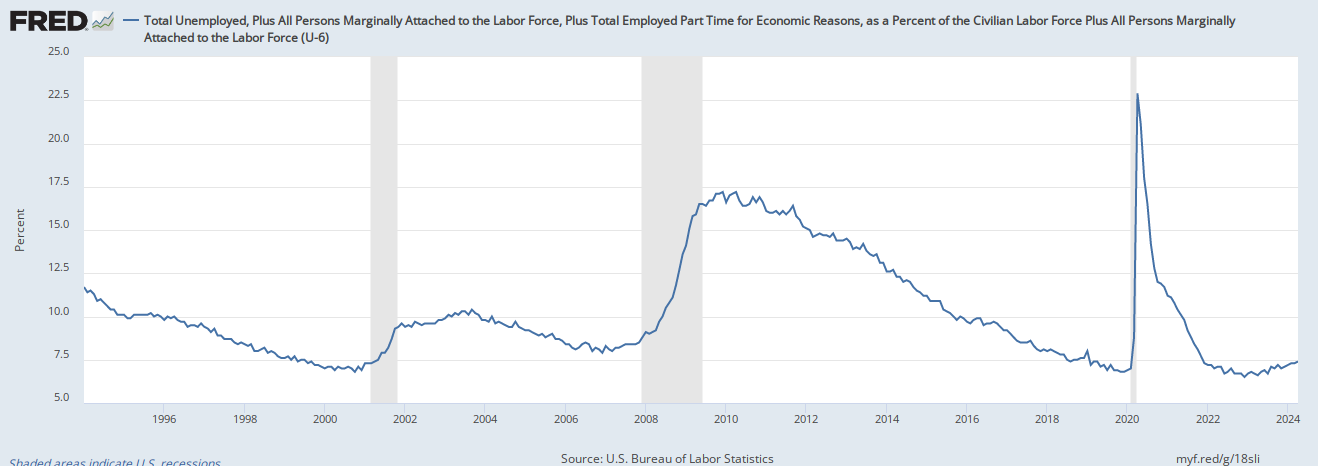

Figured I would post this here so next time someone says "no one wants to work anymore" I can link to it.

Labor force participation rate for prime age workers - 25 to 54. This is the demographic that really matters - too old for college, too young to retire - generally. Mostly considered the key age for labor force. Also the key age for consumption - the largest driver of the economy.

Hasn't been anywhere near this high since mid 1990's - when the silent generation was still working. Its very, very close to peak.

So next time someone tells you no one wants to work anymore, just refer them here.

Reference: https://fred.stlouisfed.org/series/LNS11300060

Labor force participation rate for prime age workers - 25 to 54. This is the demographic that really matters - too old for college, too young to retire - generally. Mostly considered the key age for labor force. Also the key age for consumption - the largest driver of the economy.

Hasn't been anywhere near this high since mid 1990's - when the silent generation was still working. Its very, very close to peak.

So next time someone tells you no one wants to work anymore, just refer them here.

Reference: https://fred.stlouisfed.org/series/LNS11300060