You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Home Solar

- Thread starter mattd

- Start date

@mattd get more quotes. Sunrun will match unless it is dirt low. Good luck.

I did not realize that they match prices. Are you sure that they do that? They did not share that information with me.

They all want your buisness. Get quotes and make a spreadsheet. Dates, materials, warranty, price, notes, etc.I did not realize that they match prices. Are you sure that they do that? They did not share that information with me.

Thell everyone and let them fight it out. I musta got well over 10 quotes.

Sunrun made it to the end; they told me Infinity was using top quality materials at a price they could not meet.

It was close.

Maybe call Infinity Energy in Rocklin, CA and ask for their advice. You are making a huge investment. Do your homework. I did.

Keep in mind that utility companies and legislators are working together to make it (grid tie solar) less attractive.Look forward to your experiences.

The reasoning is that the grid is a huge expense and homeowners are not due "full retail" price for the power they produce.

You could easily spend a fortune, only to find that (in the near future) you pay full price for power for the 20-21 hours of time (annualized) when the sun is not shining.

Last edited:

I wouldn't be that gloom and doom about it. The non peak sun hours are still generating something and if anything like Hawaii, you will be forced to add battery backup to ease their duck curve concern, and the battery cost would be the bigger deal than solar because they don't last 25 years like solar, and they will age even if you don't use it. Still the existing owners would likely be grandfathered and new owners will be forced to buy batteries.Keep in mind that utility companies and legislators are working together to make it (grid tie solar) less attractive.

The reasoning is that the grid is a huge expense and homeowners are not due "full retail" price for the power they produce.

You could easily spend a fortune, only to find that (in the near future) you pay full price for power for the 20-21 hours of time (annualized) when the sun is not shining.

Keep in mind that utility companies and legislators are working together to make it (grid tie solar) less attractive.

The reasoning is that the grid is a huge expense and homeowners are not due "full retail" price for the power they produce.

You could easily spend a fortune, only to find that (in the near future) you pay full price for power for the 20-21 hours of time (annualized) when the sun is not shining.

Are you referring to the bill that was passed in FL but then vetoed by the governor? I find it unlikely the government will back utility companies when between state and federal governments are funding at least 30% of the cost of residential solar projects.

Something is going to give. The growth of solar is causing states like FL to use more fuel, not less. Even the folks in Vermont are waking up to the fact that renewables come with a downside that we are unable to overcome.Are you referring to the bill that was passed in FL but then vetoed by the governor? I find it unlikely the government will back utility companies when between state and federal governments are funding at least 30% of the cost of residential solar projects.

OVERKILL

$100 Site Donor 2021

Sounds like a FIT agreement, which I'm surprised anyone is still offering, as they screw everyone else by over-paying for solar (and wind) lol. Is there a term agreement for that level of compensation; IE, is there a guarantee that you'll receive 3x retail for the duration of your loan?Yes. It goes into a “bank” for power you produce and do not use. You draw on this “bank” on cloudy days/nights etc. But they power you generate that goes back to the power company they have to buy back at 3x the rate they sell you per kWh. If you bank gets over $X (can’t recall the number) they have to cut you a check.

Also, keep in mind, you'll still have grid connection charges, so it doesn't make your whole bill disappear.

Someone needs to comment on the $40,000 up front cost I think that’s way too much for a 10 kw system.

Mine is nine years old. Cost was $20,000 for 8.6 KW. Fed tax credit $6,000. State tax credit $1,000. Utility subsidy (no longer available) $860. Net cost $12,140. Total maintenance cost $0.00. It has paid for itself and the return on investment is excellent, especially now as we face rising electricity costs.

True, but the incremental material cost should not more than double the price. Especially not 4 years later.As far as cost goes there was one other company (solar central systems) I was going to get a quote from, but the price sunrun quoted me may be the going rate around here, or Covid inflated prices. I have a co worker that had Sunrun put in an 8kW system with Tesla powerball battery (I elected to not get one) and his cost was $52K. Another co worker also had sun run put in a 7kW system with the Tesla battery and he pays 30$ less a month than they quoted me. You got a deal on yours.

Keep in mind though my system is about twice the size as the one you have.

Good luck!

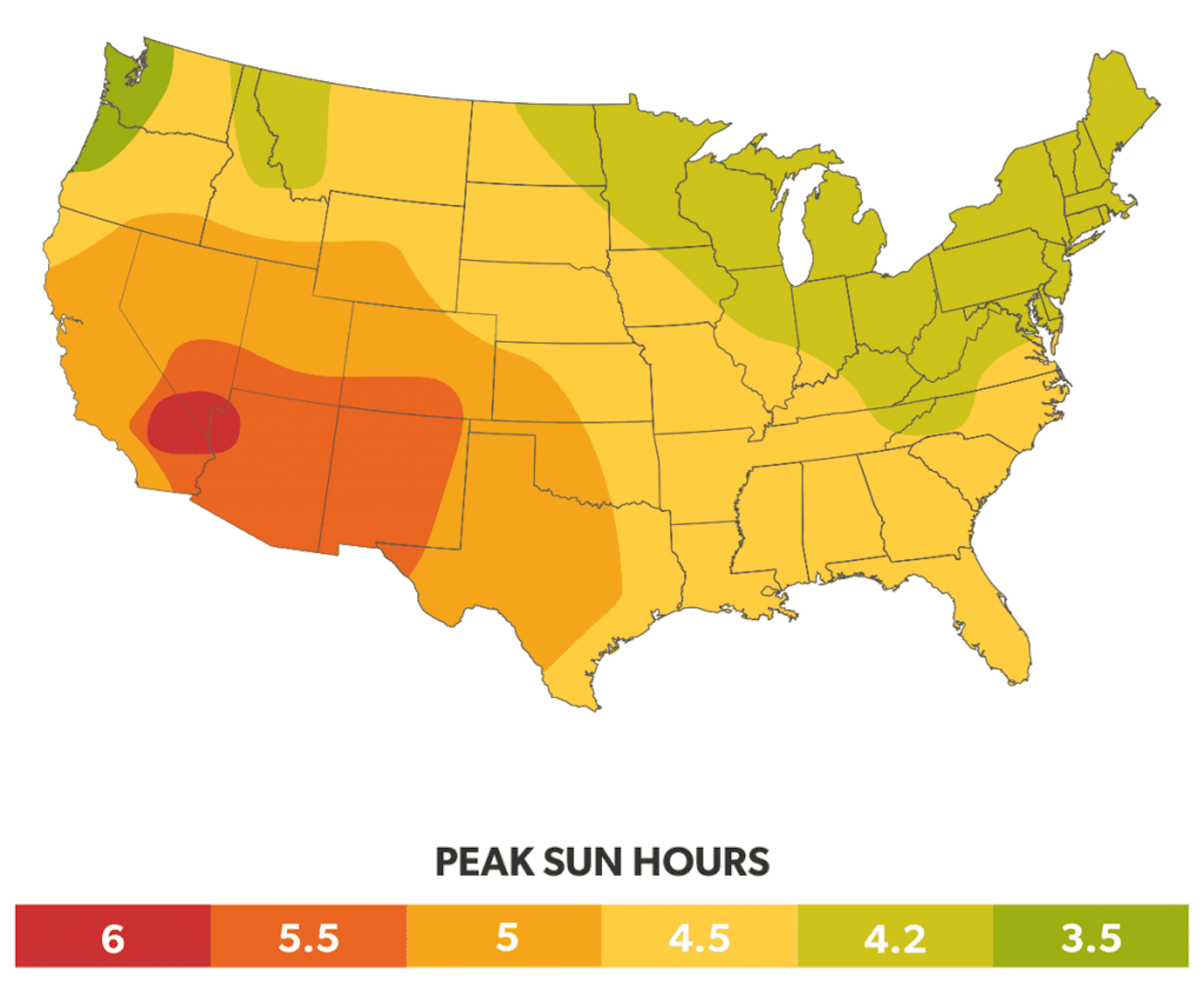

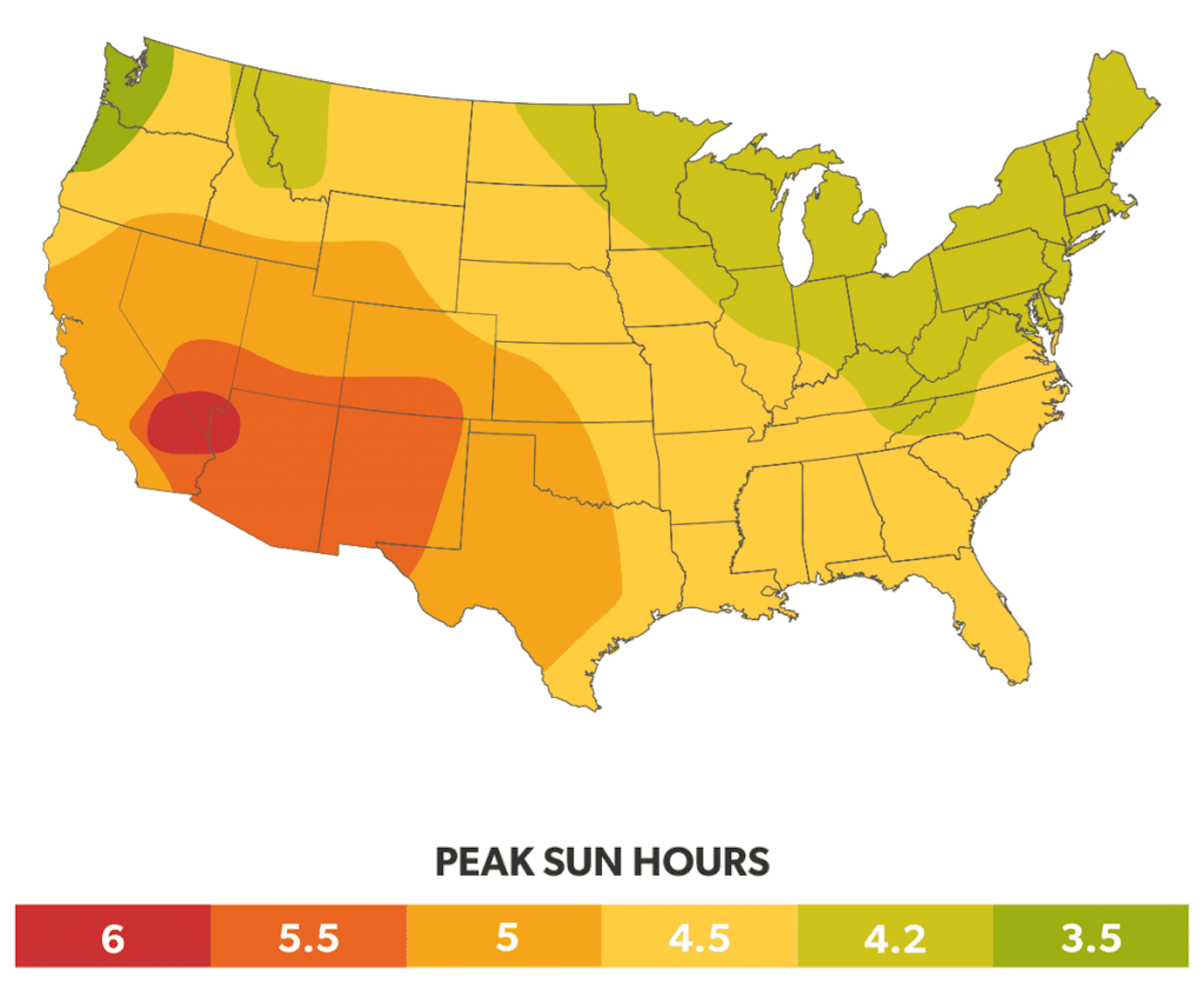

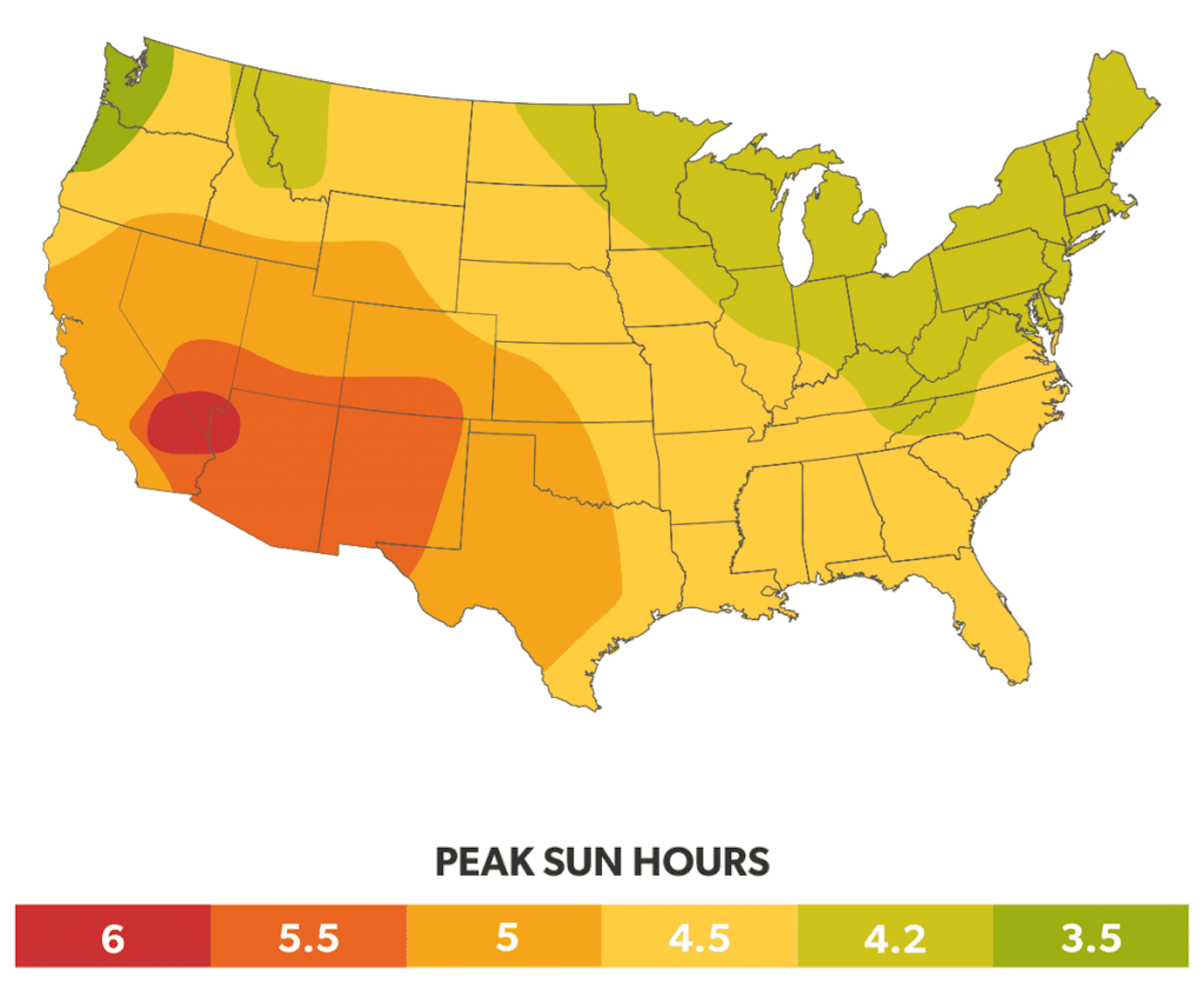

I have a similar system, Sunrun, solaredge parts, etc. I have a few more panels, as I have a large pool, and live in a desert-type climate in SoCal. The finances are a lease; I owe them $24K and it is leased until 20 years or I pay it off. I won't be selling for a few years, and will be able to tack on the remaining lease price to the house price, and then it will be paid for. Even with an 9 month pool heat pump going, I have a small surplus each month, $248 so far this year. Works well for me. I am in the red shaded area in the peak sun map above, its been 100° a few days this month already.

Last edited:

Not sure what your average price of power was but using nameplate capacity, 8.6 kw at say 7 hours per day, at an absolute max of 365 days per year would have produced 8.6 x 7 x 365 x 10 years which is 220,000 kw hrs. Subtracting the $7,000 of credits from the $20,000 leaves $13,000. At 30 cents per kw hr that would be $66,000 worth of power, a gain of $53,000. At 10 cents per kwhr that would be $22,000 worth of power, a gain of $ 9,000. The $13,000 invested in the S & P 500 ten years ago would be $48,000 plus dividends but minus tax. But now you get free power for another 15 ( and possibly more years.)Mine is nine years old. Cost was $20,000 for 8.6 KW. Fed tax credit $6,000. State tax credit $1,000. Utility subsidy (no longer available) $860. Net cost $12,140. Total maintenance cost $0.00. It has paid for itself and the return on investment is excellent, especially now as we face rising electricity costs.

Here is something about Arizona’s power cost. It’s less that 13 cents per kw hour in 2020 so maybe you should recalculate your return on investment.

Last edited:

I have a similar system, Sunrun, solaredge parts, etc. I have a few more panels, as I have a large pool, and live in a desert-type climate in SoCal. The finances are a lease; I owe them $24K and it is leased until 20 years or I pay it off. I won't be selling for a few years, and will be able to tack on the remaining lease price to the house price, and then it will be paid for. Even with an 9 month pool heat pump going, I have a small surplus each month, $248 so far this year. Works well for me. I am in the red shaded area in the peak sun map above, its been 100° a few days this month already.

I’m sure you have far more sun than me. My summer sun is at least 5 hours per day but my winter sun might only be 2+ hours due to how low in the sky the sun sits (behind trees). I use about 17kWH per day in the winter and close to 40 in the summer (4 window acs and a pool pump for 16x32 I ground pool). I’ll ask the rep about this in my next quote.

I currently pay 10 cents per kWh for delivery/transmission and 8 cents per kWh for supply. So 18 cents per kWh to get it to my house. plus a bunch of other fees/charges. Highest bill usually is around 230$. But as I said they are increasing rates drastically this winter (pre purchased power by utility company is running out). I’ve read it’s going to be 13.8c to 16c per kWh (without delivery service).

Last edited:

San Francisco area households paid an average of 30.3 cents per kilowatt hour (kWh) of electricity in April 2022, higher than the 25.7 cents per kWh paid in April 2021. The average cost of utility (piped) gas at $2.107 per therm in April was higher than the $1.707 per therm spent last year.Someone, somewhere is blowing smoke. CA avg. 20.5 cents KWH?

OH, my.

And going up.

You won't, no one writes you a check. On federal taxes, 26% of the install price of 46K (11900) can be used as a tax credit, which means that even if you are in a high bracket of say 35% that comes to 4100(ish) dollars that you won't owe.As I stated between state and local incentives I’ll be getting back essentially $15K in cash, which could be put right back on the loan, drastically decreasing the time frame for payoff.

I would suspect that your minimum utility bill would be about 35 bucks if you didn't use a single watt, so you're losing money on this deal under the present scenario.

You won't, no one writes you a check. On federal taxes, 26% of the install price of 46K (11900) can be used as a tax credit, which means that even if you are in a high bracket of say 35% that comes to 4100(ish) dollars that you won't owe.

I would suspect that your minimum utility bill would be about 35 bucks if you didn't use a single watt, so you're losing money on this deal under the present scenario.

Due to other write offs (kids, day care, etc), I always get good money back. With an extra 11,900 on top of money i am already ahead with, how would that not translate into “cash”? Either by reducing the total tax owed directly or reducing taxable income it doesn’t matter, as I’m already in the “surplus” area before I even get that 11,900 credit.

Family members and other people I know have solar say they have had 0$ (before “stay connected” cost), or very little if any bill at all. Some have even had a credit. What say you to that?

No idea what the “stay connected cost” is yet, but customer charge is 6$

Last edited:

Because it is a deduction from your total taxable income, not an actual 11.9K so the lower tax bracket you're in, the smaller the uncharged tax will be. The tax brackets are stepped depending on taxable income, so the real figure could be anywhere from 11 to 38% of the 11.9k depending on your bracket.Due to other write offs (kids, day care, etc), I always get good money back. With an extra 11,900 on top of money i am already ahead with, how would that not translate into “cash”?

Because it is a deduction from your total taxable income, not an actual 11.9K so the lower tax bracket you're in, the smaller the uncharged tax will be. The tax brackets are stepped depending on taxable income, so the real figure could be anywhere from 11 to 38% of the 11.9k depending on your bracket.

I think I owed around 16-17,000$ in tax last season prior to any deductions. So right off the bat, I would owe only 4-5,000 in taxes. The solar tax credit comes directly off your taxes owed, not your taxable income. My child tax credits exceed that, not even accounting to what I paid in taxes for the year. All the money I over paid I would just get back. Which is essentially everything I paid for the year.

Similar threads

- Replies

- 45

- Views

- 5K

- Replies

- 15

- Views

- 877

- Replies

- 52

- Views

- 3K

- Replies

- 66

- Views

- 4K

- Replies

- 184

- Views

- 15K