You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Online quotes on your vehicle

- Thread starter mjk1967

- Start date

I've found that places like CarMax appreciate my cars more when they're seen in person. I've cruised in there twice, fully-detailed and sparkling, and got a couple thousand more than I paid for them. But I'm an oldster who hasn't really adopted the online car buying experience.

They're rolling the dice on the unknown when they bid on something over the internet (even though they have the right of refusal when they see it in person) so you may get lowballed online.

They're rolling the dice on the unknown when they bid on something over the internet (even though they have the right of refusal when they see it in person) so you may get lowballed online.

terrible time right now

Carmax was 28200 on my jeep in may

27400 in june

27000 late june

26500 july

26200 late july

23000 now.

the other 3 vroom webuyanycar and carvana are less.

Trading it in for 24000(+1600 tax savings)=25600 doesnt seem bad now. Also putting 2200 miles on it in last 1.25month.

Carmax was 28200 on my jeep in may

27400 in june

27000 late june

26500 july

26200 late july

23000 now.

the other 3 vroom webuyanycar and carvana are less.

Trading it in for 24000(+1600 tax savings)=25600 doesnt seem bad now. Also putting 2200 miles on it in last 1.25month.

There has been discussion of used vehicle prices softening a tad bit. Probably reflected in the quotes and time frames.terrible time right now

Carmax was 28200 on my jeep in may

27400 in june

27000 late june

26500 july

26200 late july

23000 now.

the other 3 vroom webuyanycar and carvana are less.

Trading it in for 24000(+1600 tax savings)=25600 doesnt seem bad now. Also putting 2200 miles on it in last 1.25month.

Thanks to short supply, new car prices don't seem to be softening a bit.

They can ask what ever they want..............

a kia forte for 30k... not even The kia N version. (maybe similar to N-line)Thanks to short supply, new car prices don't seem to be softening a bit.

Makes me feel better about what I got for 37k.(cue dramatic suspense)

I will let you know it has GDI and aprox 59% of the torque of my current jeep.

For what it is worth, as painless as a quote from Carvana and Vroom are it wouldn't hurt to put your info in their system. My wife sold her car to Carvana about a year ago (we hit the market when prices were really good.) At the time Carvana's offer was better than Carmax or Vroom.

The selling process could not have been any easier. Offer made online, picture of odometer, copies of registration, drivers license, copy of vehicle loan paperwork and about a 48 hour turnaround. Then they contact you to set an appointment for pickup. Met at a local store. Lady came took picture of odometer. Pics of front, sides and rear of car. No inspection. No test drive. We sign a form or two and she hands us the check and we are finished. Five minutes tops for the whole transaction. Our outstanding loan was paid off by Carvana in less than a week.

I've always heard YMMV with Carvana, but our experience was good.

The selling process could not have been any easier. Offer made online, picture of odometer, copies of registration, drivers license, copy of vehicle loan paperwork and about a 48 hour turnaround. Then they contact you to set an appointment for pickup. Met at a local store. Lady came took picture of odometer. Pics of front, sides and rear of car. No inspection. No test drive. We sign a form or two and she hands us the check and we are finished. Five minutes tops for the whole transaction. Our outstanding loan was paid off by Carvana in less than a week.

I've always heard YMMV with Carvana, but our experience was good.

Instead of going from memory I looked up emails. I think all the online car places are dealing with massive issues

due to higher interest, high priced inventory and people with less $$$ funds. Carvana got absolutely CRUSHED on the stock market too.

These are all carmax and at the time the best offers. Which had varied previously (2021)

Jan/22

May 22

Early July

Current

due to higher interest, high priced inventory and people with less $$$ funds. Carvana got absolutely CRUSHED on the stock market too.

These are all carmax and at the time the best offers. Which had varied previously (2021)

Jan/22

May 22

Early July

Current

I used carvana as a baseline when I traded in my Rene, but the Jeep dealer I was buying the JL from gave me about a grand more than carvana. It does seem like dealers in general have no shortage of used vehicles, at least around here.

that's on pair with mine pretty muchInstead of going from memory I looked up emails. I think all the online car places are dealing with massive issues

due to higher interest, high priced inventory and people with less $$$ funds. Carvana got absolutely CRUSHED on the stock market too.

These are all carmax and at the time the best offers. Which had varied previously (2021)

Jan/22

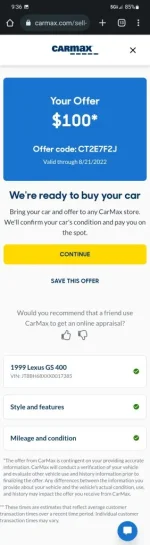

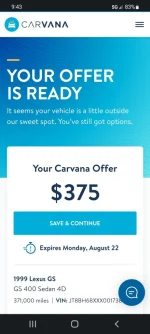

View attachment 112020

May 22

View attachment 112021

Early July

View attachment 112022

Current

View attachment 112019

the highest i got on my Accord was $25K, now its about $21K

Carvana is still pricing my 2017 Titan at near what I paid for it. Their offer is just shy of $27K

I tried to sell my 2019 Fiesta to them last summer but after I uploaded my documents I never heard back from them. I eventually sold it to a local dealer using the KBB quote system for more.

I tried to sell my 2019 Fiesta to them last summer but after I uploaded my documents I never heard back from them. I eventually sold it to a local dealer using the KBB quote system for more.

Last edited:

Carvana has made a lot of bad business decisions. Walking away from buying your Fiesta isn't one of them. The local dealer did-and the poor person who bought it from them!Carvana is still pricing my 2017 Titan at near what I paid for it. Their offer is just shy of $27K

I tried to sell my 2019 Fiesta to them last summer but after I uploaded my documents I never heard back from them. I eventually sold it to a local dealer using the KBB quote system for more.

You sold it because it was garbage.

It was anything but. It had only 11k miles, was still under factory warranty, and absolutely everything on it worked perfectly.Carvana has made a lot of bad business decisions. Walking away from buying your Fiesta isn't one of them. The local dealer did-and the poor person who bought it from them!

You sold it because it was garbage.

I sold it because I made a significant profit on it. https://bobistheoilguy.com/forums/threads/goodbye-2019-ford-fiesta-you-served-me-well.342441

Last edited:

My opinion of Carvana or other "all online" dealers is that they are focusing on the near new models that they can turn quickly, without having to use "Salesmanship" to sell to save labor and commission. This kind of "software like" approach they are trying to sell to investor is that you only need very few R&D for business and it can scale like a software company, no need to hire more people to sell more car once you build those vending machines. That means those cars have to be cookie cutter commodities.

The problem they have is, we have a shortage of any car, so there is no way they can scale like a software company, and therefore more like a hardware company with chip shortage. The VC funding is also drying up and they will have problems soon if they got cut off and have a runway problem.

They also do not have a moat on their business model. Anyone can do these self help like new commodity retail business. Rental car companies can do it themselves, new car dealership can do it, Tesla can do it, Amazon can do it.

So, what's the incentive to invest in Carvana and what they bring to the table in the long run?

The problem they have is, we have a shortage of any car, so there is no way they can scale like a software company, and therefore more like a hardware company with chip shortage. The VC funding is also drying up and they will have problems soon if they got cut off and have a runway problem.

They also do not have a moat on their business model. Anyone can do these self help like new commodity retail business. Rental car companies can do it themselves, new car dealership can do it, Tesla can do it, Amazon can do it.

So, what's the incentive to invest in Carvana and what they bring to the table in the long run?

offered 800$ for my 2003 kia sorento with only 160k . no thanks

Similar threads

- Replies

- 26

- Views

- 771