I would be concerned if the company was trading over 50 times earnings. But having said that there were some headwinds caused by interest rates and bank failures.You tell me.

If you had a product that had 100% growth, then 70%, now 36%, Quarter vs. Quarter, would you be thrilled or concerned?

After just a few years, that product is moving in the WRONG direction.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

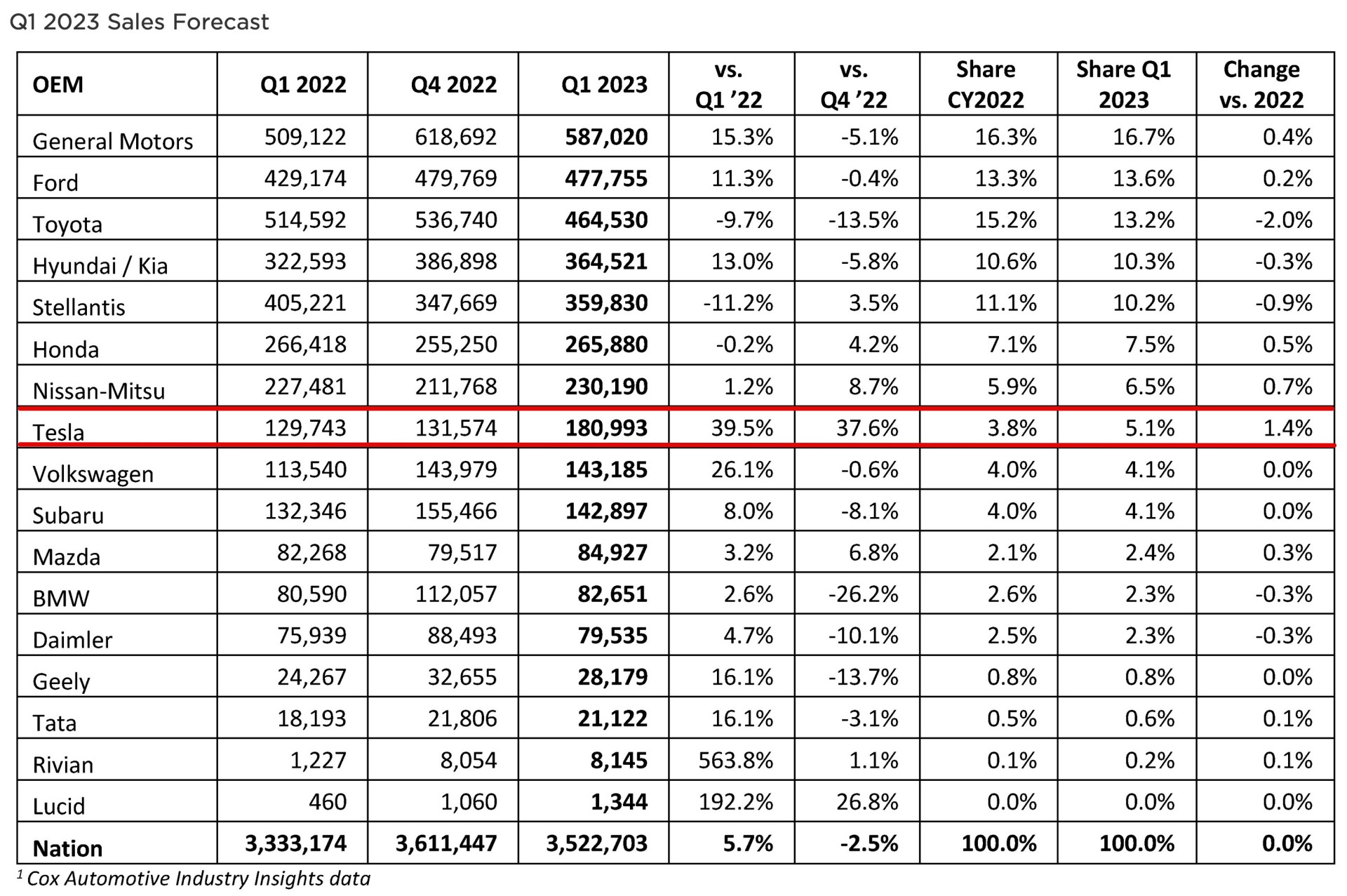

Tesla Q1 sales flatlining, as I have predicted

- Thread starter leadcounsel

- Start date

This. Everything is against them, but even though they've slowed, they're still showing growth. Is it all positive? No, but I don't think it's red flag time just yet.I would be concerned if the company was trading over 50 times earnings. But having said that there were some headwinds caused by interest rates and bank failures.

@leadcounsel I don't have the numbers in front of me; perhaps you do...

Didn't Tesla just have the best Q4 to Q1 growth in the their history?

Lemme know your thoughts; I am not sure if this is correct but I believe it is.

Given the 422K number, they have a strong shot at 2M deliveries this year, right?

Didn't Tesla just have the best Q4 to Q1 growth in the their history?

Lemme know your thoughts; I am not sure if this is correct but I believe it is.

Given the 422K number, they have a strong shot at 2M deliveries this year, right?

Last edited:

leadcounsel

Thread starter

Tesla's Q4 v. Q1 following year:@leadcounsel I don't have the numbers in front of me; perhaps you do...

Didn't Tesla just have the best Q4 to Q1 growth in the their history?

Lemme know your thoughts; I am not sure if this is correct but I believe it is.

Given the 422K number, they have a strong shot at 2M deliveries this year, right?

2017: 30,000 vs. 35,000: 16% increase.

2018: 86,500 vs. 63,000: (-25% decrease)

2019: 112,000 vs. 89,000: (-25% decrease) *Pandemic Q1 2020

2020: 180,000 vs. 184,000. 2% increase

2021: 308,000 vs. 310,000. 2022: 405,000 vs. 422k. 4% increase. *Big price cuts, plus rebate incentives.

So, to answer the question, it appears all over the map. Lots of big variables, hard to identify any obvious trends b/t Q4 to Q1 other than yes, I agree, sales appear to be higher/stronger in Q4 and/or lower/softer in Q1. Probably as you pointed out year end sales, tax incentives, plus new model/years in Q4, and Q1 tends to be stagnant for many industries, etc.

As I said in the OP, Tesla did well among peers for Q1 with 4% growth, no doubt. Excellent sale numbers overall, record breaking quarter. Compared to 2019 and 2020 with negative growth, it's an excellent quarter increase. Compared to the last two years, it's nominally better. Compared to 2018, it's terrible. I will, again, note that Tesla radically dropped pricing to achieve this 4% increase. Smart play, or desperate play, time will tell. I stand by my original assessment overall however of sales slowing among many consumer goods including cars and I think Tesla could be in trouble.

Shanghai run rate 1M vehicles per year

Fremont run rate 500K

Berlin 250K and ramping

Austin 200K and ramping

Monterrey breaking ground. As Berlin and Austin approach capacity, Monterrey will be ramping. The next factory is expected to be in the US.

2M deliveries this year is doable, but hiccups could make a difference. Incredible company growth and they continue to take marketshare from other car makers.

In business, this is known as exponential growth. It is why the market expects absurd growth from Tesla vs other car manufacturers.

Finally, looking at individual quarters is missing the long term outlook. Short term thinking is meaningless.

A common growth metric is trailing 12 month totals:

Fremont run rate 500K

Berlin 250K and ramping

Austin 200K and ramping

Monterrey breaking ground. As Berlin and Austin approach capacity, Monterrey will be ramping. The next factory is expected to be in the US.

2M deliveries this year is doable, but hiccups could make a difference. Incredible company growth and they continue to take marketshare from other car makers.

In business, this is known as exponential growth. It is why the market expects absurd growth from Tesla vs other car manufacturers.

Finally, looking at individual quarters is missing the long term outlook. Short term thinking is meaningless.

A common growth metric is trailing 12 month totals:

Last edited:

edyvw

$50 site donor 2025

Idk about Q1 and Q4, but Musk is officially a guy that lost most amount of money =ended up in Guinness bcs. that.

And he is still the richest or 2nd richest person in the world. I think Arnault family is currently #1.Idk about Q1 and Q4, but Musk is officially a guy that lost most amount of money =ended up in Guinness bcs. that.

4WD

$50 site donor 2025

In no bind either way - probably changes rank often …And he is still the richest or 2nd richest person in the world. I think Arnault family is currently #1.

https://www.marketwatch.com/story/e...k-surge-adds-7-billion-to-his-wealth-4ba62cdb

I agree with most of what you wrote in this thread and the reasoning behind it has been the same as I have been saying for the last year.Tesla's Q4 v. Q1 following year:

2017: 30,000 vs. 35,000: 16% increase.

2018: 86,500 vs. 63,000: (-25% decrease)

2019: 112,000 vs. 89,000: (-25% decrease) *Pandemic Q1 2020

2020: 180,000 vs. 184,000. 2% increase

2021: 308,000 vs. 310,000. 2022: 405,000 vs. 422k. 4% increase. *Big price cuts, plus rebate incentives.

So, to answer the question, it appears all over the map. Lots of big variables, hard to identify any obvious trends b/t Q4 to Q1 other than yes, I agree, sales appear to be higher/stronger in Q4 and/or lower/softer in Q1. Probably as you pointed out year end sales, tax incentives, plus new model/years in Q4, and Q1 tends to be stagnant for many industries, etc.

As I said in the OP, Tesla did well among peers for Q1 with 4% growth, no doubt. Excellent sale numbers overall, record breaking quarter. Compared to 2019 and 2020 with negative growth, it's an excellent quarter increase. Compared to the last two years, it's nominally better. Compared to 2018, it's terrible. I will, again, note that Tesla radically dropped pricing to achieve this 4% increase. Smart play, or desperate play, time will tell. I stand by my original assessment overall however of sales slowing among many consumer goods including cars and I think Tesla could be in trouble.

I feel you're missing some key points OR maybe better said some not understanding your full posts.

Telsa is a small automaker and not even in the top ten automakers world wide as as far as the USA sales I would think much the same.

(Tesla does not publish their USA sales figures, go figure)

The sales increase year over year do not mean much when you are new to the market. They only sell one type of vehicle, Electric.

Anyone can start a business with something new, something never sold before and increase sales dramatically year after year but still no where near the sales of the big companies that produce vehicles with the ICE. Same product, different propulsion.

Fast forward to today, its really retail sales 101, Tesla makes an electric car, sales took off for people who wanted one. Easy stuff but back to retail sales 101. They sell a product that everyone already makes, except Tesla is battery powered, Tesla filled a void for a specific vehicle.

Guess what? It's easily copied by the same world wide companies that already produce vehicles and they are now starting to produce EVs for this limited market. The market is going to implode in less than 5 years with an excess of EV vehicles much like any new product, (example = flat screen TVs, computers in the 1990s and 2000s.

Look at it this way, who was first to come out with SUVs? Public liked them, everyone in the world started producing them. No different than the current EV market and Tesla is at a huge disadvantage, they dont even have showrooms.

Ok, let's get to sales numbers, they are horrible! Does anyone in this forum ask what would have happened to Tesla this year if the American Taxpayer did not subsidize the purchase of their vehicles with a $7,500 income tax credit? SEVEN THOUSAND FIVE HUNDRED DOLLARS! Can you imagine if all vehicle makers were able to sell cars with that incentive on their ICE vehicles?

Tesla has to get their act together and FAST. The world is about to explode with EVs and Tesla is just a tiny player.

Tesla is selling at FIFTY times earnings when other makers sell at 4 to 10 times earnings.I would be concerned if the company was trading over 50 times earnings. But having said that there were some headwinds caused by interest rates and bank failures.

Tesla stock is down 50% in the last 12 months

Tesla sales would be in the toilet this year if it wasnt for the American taxpayer subsidizing their cars, with $7,500 in tax credits.

The legacy ICE companies are doing great considering they cant offer the same $7,500.

Tesla does not release their financial results until late in the day April 19th. SO we still do not know how they are doing but with the American taxpayer kicking in a huge subsidy for them I would assume MAYBE doing ok. Subsidy's will die one day as the public gets annoyed.

stop the salt, at the end of the day they have a compelling product people want to drive. these vehicles continue to sell in every suburban and metropolitan area. the end

i still hate this guy and his lies with a passion and am praying on his downfall

i still hate this guy and his lies with a passion and am praying on his downfall

Who has a compelling product, Tesla? If so maybe we need to know that Tesla sales in the USA are a tiny fraction of the automobile market, maybe a growing market but every other much, much larger automakers in the world will be selling the same item and also have ICE vehicles, something Tesla does not.stop the salt, at the end of the day they have a compelling product people want to drive. these vehicles continue to sell in every suburban and metropolitan area. the end

I also question the "compelling product"

Its certainly isnt compelling this quarter, how can a product be compelling when I company is forced to slash prices to keep the product moving but not only have they slashed prices, the taxpayers are doubling the price cuts to the tune of $7,500 plus the already Tesla price cuts. I dont call this compelling. I call it a dud and the ICE vehicle makers are coming out with awesome looking EVs to add to their lineup against the very stale Tesla line up.

BTW- even with Tesla slashing prices in the USA and even with the USA taxpayer kicking in another $7,500 to purchase a Tesla, USA first quarter deliveries are stagnant at best. It's hard to tell because Tesla hides and doesn't report USA sales numbers but the small increase this quarter is being attributed to the China market. So we have roughly $15,000 in USA Tesla prices cuts and almost no increase in deliveries as far as I see it.

Last edited:

The #1 selling vehicle in the world and the highest revenue vehicle in the world. Anything close is a low price, low margin product. The Model Y is a high price high margin product.Who has a compelling product, Tesla? If so maybe we need to know that Tesla sales in the USA are a tiny fraction of the automobile market, maybe a growing market but every other much, much larger automakers in the world will be selling the same item and also have ICE vehicles, something Tesla does not.

I also question the "compelling product"

Its certainly isnt compelling this quarter, how can a product be compelling when I company is forced to slash prices to keep the product moving but not only have they slashed prices, the taxpayers are doubling the price cuts to the tune of $7,500 plus the already Tesla price cuts. I dont call this compelling. I call it a dud and the ICE vehicle makers are coming out with awesome looking EVs to add to their lineup against the very stale Tesla line up.

BTW- even with Tesla slashing prices in the USA and even with the USA taxpayer kicking in another $7,500 to purchase a Tesla, USA first quarter deliveries are stagnant at best. It's hard to tell because Tesla hides and doesn't report USA sales numbers but the small increase this quarter is being attributed to the China market. So we have roughly $15,000 in USA Tesla prices cuts and almost no increase in deliveries as far as I see it.

I would consider that compelling. What is your definition of compelling?

You agree with leadcounsel; is that on his title "Tesla Q1 sales flatlining" or post #24 where he said "As I said in the OP, Tesla did well among peers for Q1 with 4% growth, no doubt. Excellent sale numbers overall, record breaking quarter."

You post Tesla sales are a tiny fraction of the automobile market. Exactly. And they continue to take market share from the big boys, outselling BMW and MBZ combined in this qtr in the US. More than VW as well. In fact, Tesla's U.S. market share is seen surpassing 5% for the first time.

Last edited:

Around the time that the nattering nabobs of negativism are predicting Tesla (and EV sales in general) will "flatline", Tesla will have in full production a sub-$35k or even a sub-$30k model available, interest rates will be back down below 3% and we'll have yet again another gas crisis with average prices in excess of $5 per gallon.

What do you think Tesla's numbers will look like then ?

It is also a big mistake to not consider Tesla to be a tech company. While we can evaluate only their vehicle sales for the sake of discussion, they have revenue streams coming in from other products. And the predictions for those other products are huge. How the market reacts to the Q1 2023 numbers is only relevant if you are a short term investor.

What do you think Tesla's numbers will look like then ?

It is also a big mistake to not consider Tesla to be a tech company. While we can evaluate only their vehicle sales for the sake of discussion, they have revenue streams coming in from other products. And the predictions for those other products are huge. How the market reacts to the Q1 2023 numbers is only relevant if you are a short term investor.

Does anyone in this forum ask what would have happened to Tesla this year if the American Taxpayer did not subsidize the purchase of their vehicles with a $7,500 income tax credit? SEVEN THOUSAND FIVE HUNDRED DOLLARS!

Everyone following Telsa asked that question the first time the subsidy cap was reached with many predicting incorrectly that sales would crash.

Tesla is only selling 4 models, and mostly 2, the 3 and Y. The 3 and Y probably share the majority of the expensive parts as well, so tesla has so much simpler production lines than what GM, Ford, Toyota, VW, have, and make much more money per unit.

Currently the total US electric car market share is around 5%(Tesla is 2/3 of that), and I would guess it could easily go to 25%, so Tesla will probably get up to 3M cars a year in the next 2 years.

I think their only serious mistake is the Cybertruck... Tesla should have head hunted all the key pickup design engineers for Ford, GM, and RAM and came out with a better pickup truck, that also happens to be electric. Then they would shoot to number 1 in auto sales in the US quite quickly.

Currently the total US electric car market share is around 5%(Tesla is 2/3 of that), and I would guess it could easily go to 25%, so Tesla will probably get up to 3M cars a year in the next 2 years.

I think their only serious mistake is the Cybertruck... Tesla should have head hunted all the key pickup design engineers for Ford, GM, and RAM and came out with a better pickup truck, that also happens to be electric. Then they would shoot to number 1 in auto sales in the US quite quickly.

Most of the legacy companies have EVs, right? They are eligible for the tax credit too, right?Tesla is selling at FIFTY times earnings when other makers sell at 4 to 10 times earnings.

Tesla stock is down 50% in the last 12 months

Tesla sales would be in the toilet this year if it wasnt for the American taxpayer subsidizing their cars, with $7,500 in tax credits.

The legacy ICE companies are doing great considering they cant offer the same $7,500.

Tesla does not release their financial results until late in the day April 19th. SO we still do not know how they are doing but with the American taxpayer kicking in a huge subsidy for them I would assume MAYBE doing ok. Subsidy's will die one day as the public gets annoyed.

Doing great? Perhaps review the US sales numbers in post #33.

I am not in favor of the subsidies; Musk has said that many times.

How do you feel about the many ICE bailouts and big oil subsidies? I always wonder why some bring up subsidies in a partial vacuum...

At the risk of repeating the same old subject over and over, a major refresh is in order.

Right or wrong, Tesla is not doing major refreshes. The lineup is getting a little long in the tooth.At the risk of repeating the same old subject over and over, a major refresh is in order.

Sales are still strong; but when will the market tire of S3XY?

There is the Model 3 Highland refresh project, but that's a refresh. I am likely a Performance model customer.

leadcounsel

Thread starter

Disagree.Currently the total US electric car market share is around 5%(Tesla is 2/3 of that), and I would guess it could easily go to 25%, so Tesla will probably get up to 3M cars a year in the next 2 years.

First, pickup trucks account for the majority of new vehicle sales (6 of top 10 sellers). SUVs are next (2 of top 10 sellers). Tesla won't be able to make a pickup truck with the features that pickup owners need or want. Similar assessment for SUVs.

Secondly, the infrastructure and tech is nowhere near enough to support beyond a 10% adoption. And ultimately TESLA will experience strong competition when 10 companies crack the code, and have to radically cut profitability. We're probably a decade away, maybe 2. And that will probably be set back by a global economic shift, US dollar collapse, and global hot wars in 1-3 years. EVs will be low priority in our near future. People will want very reliable long range ICE that are easy to power and fix.

Third, anyone who wanted an EV, has one. Growth is slowing. And, whilst 36% Q1 to Q1 might sound impressive, the reality is that figure on the heels of a trend from 100%, to 68%, to now 36%, it's a dramatic decline trend and the worst Q1 to Q1 comparison in the most recent years, and the LOWEST SINCE AT LEAST 2017. And, as mentioned, this is with huge price reduction/gimmicks of cutting prices PLUS big tax rebates that pay for 1/4 of the price of the cars. Put the corks back in the champagne bottles. These are indications of a stalling demand, stagnating economy.

We're at around a 4-5% total US adoption, grossly disproportionately in a few CA zip codes where the climate and customer base is perfect for EVs. That's unique and hard to replicate in most of the rest of the US, where adoption is closer to 1% on average. Anyone who wants a Tesla, has one by now. That is reflected by essentially flat Q4 to Q1 this year, and a hard drop in Q1 to Q1 comparisons for several years. No way we'll see a 25% adoption in a few years. Maybe high single digits at most.

Agreed with the analysis. I would HOPE an effective 25-35% effective price slash would stimulate demand. Yet it's barely higher than the previous 2 years of Q4 to Q1 comparisons, and it's the worst Q1 to Q1 in several years. Not good metrics, in spite of "record sales." It's quickly cooling, due to saturated market and micro/macro economic issues...even with Tesla slashing prices in the USA and even with the USA taxpayer kicking in another $7,500 to purchase a Tesla, USA first quarter deliveries are stagnant at best. It's hard to tell because Tesla hides and doesn't report USA sales numbers but the small increase this quarter is being attributed to the China market. So we have roughly $15,000 in USA Tesla prices cuts and almost no increase in deliveries as far as I see it.

A final small note, while stock prices day-to-day are a poor indication, it's a data point of consumer/investor short term enthusiasm. Generally sales news does impact a stock price next day. Apparently investors aren't pleased with TSLA's sales, stock is down 6% today. If it were good news, we would expect an increase. If the news were neutral, we'd expect no stock price fluctuation. It's down 6%. Not horrible, but a data point to further support my analysis. As noted, in 12 months TSLA is down 50%. That is a good data point to correct an over-valued company. I suspect it needs to come down another 25%, given the unjustified over-valuations.

Last edited:

Similar threads

- Replies

- 27

- Views

- 2K

- Replies

- 50

- Views

- 4K

- Replies

- 30

- Views

- 6K