- Joined

- Nov 6, 2022

- Messages

- 339

Thanks. I don't recall making any political commentary. I will do my best to avoid it!He was referring to political discussion.

You are free to talk about the economy.

Thanks. I don't recall making any political commentary. I will do my best to avoid it!He was referring to political discussion.

You are free to talk about the economy.

I agree if it was 10M that would’ve been terrible because that would’ve meant we actually lost 7.1M real jobs. But it wasn’t 10M jobs, and the jobs that were real were still a good number of jobs. As usual, your comment is nonsense.Correct, 818k jobs we thought existed, disappeared. You can spin it any way you want. If the number was 10 million, would it be no big deal too because they "simply never existed"? Ya, sounds pretty ridiculous doesn't it.

Re: "freaking out" - this is good news for the market, hence what you perceived as not a big deal. We are in the "bad news is good news" stage. We are now moving to there likely being 25bp cuts in the next successive 4 meetings, for a grand total of 100 bps. That's bullish for the market...

What is nonsense about 818k jobs disappearing overnight, sir? Explain for the plebes.I agree if it was 10M that would’ve been terrible because that would’ve meant we actually lost 7.1M real jobs. But it wasn’t 10M jobs, and the jobs that were real were still a good number of jobs. As usual, your comment is nonsense.

Equating 800K jobs that still left healthy job growth to 10M jobs which would’ve been devastating. You seem like a bright person but you’re more interested in trying to prove you’re the smartest person in the room than actually having a meaningful discussion and it’s tedious and exhausting and it goes nowhere. So…I wish you well.What is nonsense about 818k jobs disappearing overnight, sir? Explain for the plebes.

Say what you want, but it is the **Second Worst Revision In US History**.Equating 800K jobs that still left healthy job growth to 10M jobs which would’ve been devastating. You seem like a bright person but you’re more interested in trying to prove you’re the smartest person in the room than actually having a meaningful discussion and it’s tedious and exhausting and it goes nowhere. So…I wish you well.

You are still missing the point. The correct(?) revised lower number is showing a slowly cooling economy, aka soft landing, so the Fed believes it is time to lower the Prime.Say what you want, but it is the **Second Worst Revision In US History**.

We can have a meaningful discussion, I just can't do anything with "the jobs were great". I'm not offended if you disagree, however it does seem that my stance is drawing your ire.

The thing we know as the GDP number is really just an initial estimate. One of the larger inputs iinto that estimate is jobs. Of course its not the only input into that number, but still I wouldn't be surprised to see the GDP estimates revised down next go around.Millions of jobs did not disappear over night. These aren’t real people losing jobs - they simply never existed. Even with the 800K jobs not existing, job growth was still robust, just not as robust as thought, and so little has changed based on the revised jobs report.This is part of the reason why the market did not freakout. It was already factored in and it doesn’t change the outlook all that much.

Pablo, perhaps check out a few economic periodicals; perhaps they are bragging as well? All good.You miss the point as well. But ok

Also you really can’t undo 12 months of bragging

How do you know the average American is not doing well?I respectfully disagree about the soft landing and the economy is bulletproof.

How would things be if trillions and trillions of cash NOT pumped into economy ?

I have to admit I’m doing very well….. the average American is not doing so well and barely making it with everything that’s going on. Look at all the debt and defaults. Three generations of families living under one roof.

There’s a few folks that I talk to by PM and know how I feel about this puppet show…..

They know who they are.

I just hit an all time high today in my Vanguard account and Fidelity 401K.

Thanks Joe, Janet and Jerome, keep up the great job.

I suggest you look up stagflation; it is quite the opposite of today's economy.Re: "agenda" - They say "every accusation is an admission"

When I see a million jobs disappear overnight, “soft landing” is the last thing that comes to mind. Sorry you don’t like the data, that’s not my problem.

I don't even know what this means.

What I think you mean is, the Fed needs to choke off inflation while being cognizant of the deteriorating employment situation. If that's the case, then we are in agreement. So-called "stagflation".

The thing about GDP is the so-called "Crowding Out" (and Multiplier) Effect. Basically, the government spends a lot of money, in turn the Private sector spends a lot of money, and since that is one of the inputs of GDP, GDP goes up, and due to the multiplier, sometimes more than just the sum of Government Spending.The thing we know as the GDP number is really just an initial estimate. One of the larger inputs iinto that estimate is jobs. Of course its not the only input into that number, but still I wouldn't be surprised to see the GDP estimates revised down next go around.

When CEO's see the economy slowing they tend to shed jobs, or at minimum stop hiring. So its a self feeding cycle.

So the only reason it matters is if CEO's read the tea leaves and decide they need to get ahead of it. If they do not, then no it does not matter. However one of the reasons the Sahm rule triggered a sell off was that every other time it triggered the unemployment rate went much higher.

In the end the stock market is not the economy either.

These are the best of times and these are the worst of times...I think we are experiencing the greatest of easy times in the history of the country, enjoy it while you can, all the gloom and doom is mass media. The gloom should be focused on why it is happening and that is solely because of the national debt. Someday, have no clue when, 10 years? sooner or later it has to stop I think, but we do not know because never in history have we been here.

http://usdebtclock.org

All I know is I am really upset I sold my NVDA ... at least until Wed, maybe I'll get a chance to buy it back or maybe I should just have bought it. Ive had nice run over the years but this was one timing miss step. Im in fully with WMT and META ... and have 1/3 cash sitting on the side and feeling like I missed a great chance with either NVDA or GM ... but that can change on Monday, who knows.

Stupid me, I am so annoyed *LOL*

How do you know the average American is not doing well?

That's a talking point not based on current studies.

Unemployment is on an uptrend. In fact, civilian unemployment is at a 7-year high when accounting for the Covid anomaly. If you want to add Covid back in just for the heck of it, we're still at a 3-year high, Not good, either way.Evidence of stagnation includes persistent unemployment, flat job growth, no wage increases, and a lack of stock market booms.

This number was known months in advance if you went over to any of what you called "conspiracy websites". The Philly Federal Reserve actually said as much in a report they released I believe in March.You are still missing the point. The correct(?) revised lower number is showing a slowly cooling economy,

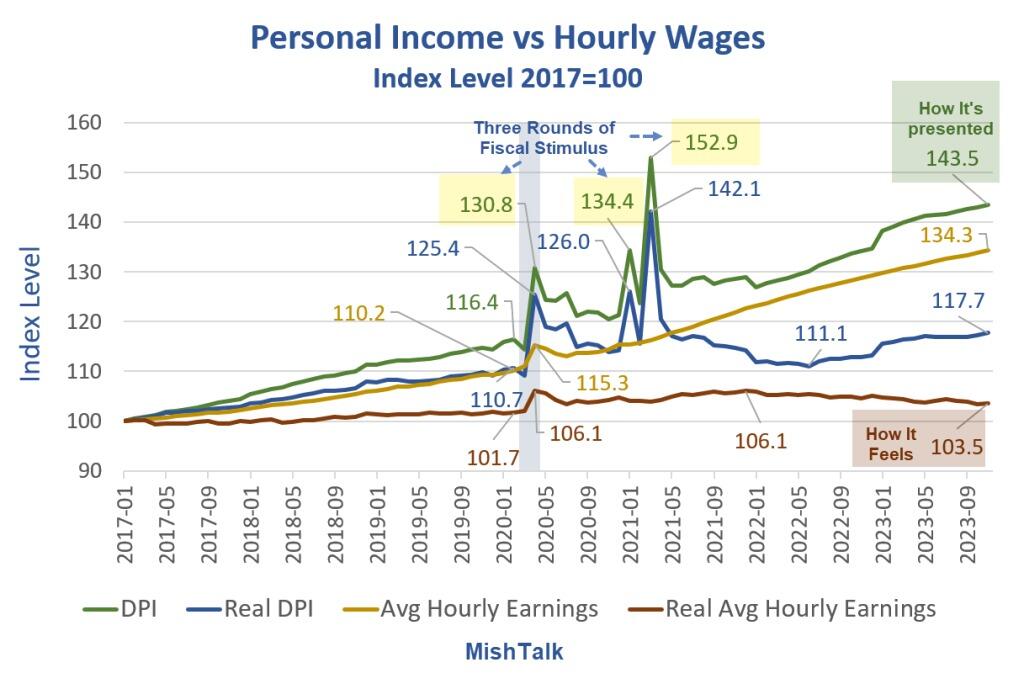

Stagnant wages - Not here. My payroll is up 25% in 4 years and national data says wage growth is outpacing inflation.Stagnant wages, small raises at work, crazy inflation, cost of living increasing exponentially, costs to raise a family (kids very very expensive), housing very expensive, credit card debt, low savings rate, low retirement contributions, healthcare / dental care costs, etc…

I don’t want to argue the fact that older affluent folks are in a much different situation than “the average American” with 3 kids and trying to live the American Dream in 2024.

I told the story of my dad being an A&P mechanic for PanAm and supported a family of 6 on one paycheck.

That was easy to do in 1970…… impossible to do the same in 2024.

"Nearly one-fifth of Americans have ‘maxed out’ their credit cards as inflation and high interest rates push delinquencies to 3-year high"Credit card debt - Yup, definitely spiked after going down during CV-19