The yield curve is deinverting and this would be the longest time between inversion and the onset of recession in history. We live in unique times and much like historical returns do not guarantee future returns, the inverted yield curve may no longer signal what it did in the past.Except for that whole inverted yield curve thing.

You might be surprised to learn the Fed has never actually managed to pull off a "soft landing" in the last several decades.

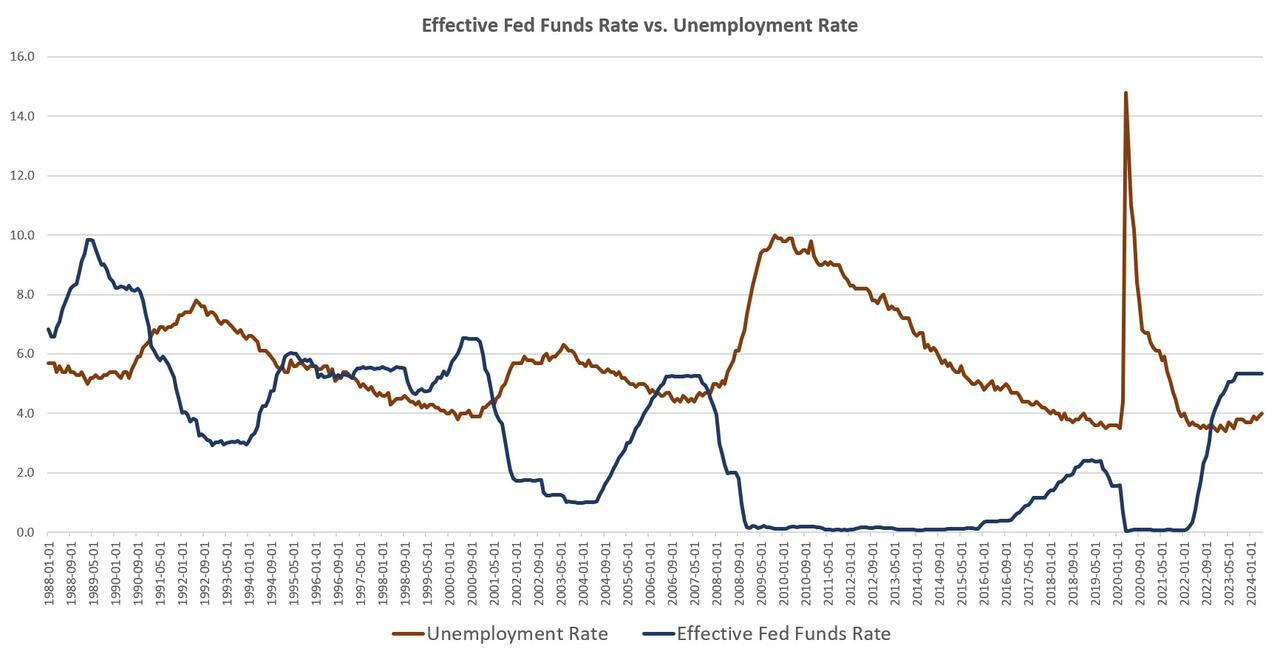

Tell me if you can spot the trend:

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

*Investors Blog*

- Thread starter Warstud

- Start date

- Joined

- Nov 6, 2022

- Messages

- 339

Correct it is just one data point, but the chart I've now posted twice does not lie.The yield curve is deinverting and this would be the longest time between inversion and the onset of recession in history. We live in unique times and much like historical returns do not guarantee future returns, the inverted yield curve may no longer signal what it did in the past.

Now see what you startedYou guys are risk adverse (as am I) but no mention of Riley anything???

B. Riley. Am I missing something? The 200th largest commercial bank if failing - or is there more to it?

The inverted yield curve is an indicator of a possible recession. This is where I disagree; you seem to be stating something different. Economics theory tries to explain the past; it does not claim to know the future. Models are used for forecasting.Correct it is just one data point, but the chart I've now posted twice does not lie.

Sure it does, an inverted yield curve has failed to predict recession twice since 1955. Also, what is it? It is a measure of investor’s perceived short vs long-term risk. Unfortunately, in the past decade short-term risk has been politicized to the point where it is no longer objective for a large portion of the population. If their guy is in then risk is low and if not it’s high. We simultaneously have the best and the worst economy right now depending on who you talk to. I’ve watched on BITOG for four years people claim recession was imminent regardless of the economic indicators. Add to this the influence of social media and globalism. As I said, we live in unique times, and this may make the yield curve totally unreliable.Correct it is just one data point, but the chart I've now posted twice does not lie.

Last edited:

I didn't even know their ranking.Now see what you started

B. Riley. Am I missing something? The 200th largest commercial bank if failing - or is there more to it?

But what a sham they were pulling off!

Their preferred and other debt like instruments pulled some folks in, but yeah. No.

- Joined

- Nov 6, 2022

- Messages

- 339

I'm talking about the relationship between the Fed Funds Rate and Unemployment, where pretty much every time the Fed has cut rates, it is immediately proceeded by a spike in unemployment and a recession. I don't see any reason why this time it might be different.The inverted yield curve is an indicator of a possible recession. This is where I disagree; you seem to be stating something different. Economics theory tries to explain the past; it does not claim to know the future. Models are used for forecasting.

- Joined

- Nov 6, 2022

- Messages

- 339

Not me.I’ve watched on BITOG for four years people claim recession was imminent regardless of the economic indicators.

What say ye on the chart I posted?

Yes, I see the increase in FFR preceded a spike in unemployment. As for right now, the slight uptick in unemployment at the far right of the curve is totally expected, it is the entire point of raising the FFR, and since I’m not a wizard who can predict the future, we will just have to wait and see. As I said, unique times.Not me.

What say ye on the chart I posted?

- Joined

- Nov 6, 2022

- Messages

- 339

Did you mean it's the entire point of cutting the FFR?Yes, I see the increase in FFR preceded a spike in unemployment. As for right now, the slight uptick in unemployment at the far right of the curve is totally expected, it is the entire point of raising the FFR, and since I’m not a wizard who can predict the future, we will just have to wait and see. As I said, unique times.

They read John Corzine's memoirs and put the plan into action.I didn't even know their ranking.

But what a sham they were pulling off!

Their preferred and other debt like instruments pulled some folks in, but yeah. No.

He's like a favorite around here. HahahahahahahaThey read John Corzine's memoirs and put the plan into action.

The point of raising the FFR is to SLOW the economy through increased unemployment. When the borrowing cost goes up for corporations, they fund less capital projects and need fewer people. Those unemployed people spend less money and the economy slows. The Fed has two main mandates - 2% inflation and maximal SUSTAINABLE employment - inflation and unemployment are inextricably linked.Did you mean it's the entire point of cutting the FFR?

Because that is not what is happening.I'm talking about the relationship between the Fed Funds Rate and Unemployment, where pretty much every time the Fed has cut rates, it is immediately proceeded by a spike in unemployment and a recession. I don't see any reason why this time it might be different.

There's no way to predict a recession; indicators and models attempt to but the US economy has defied those models. In 2023 about 70% of economic experts were predicting recession; today it is about 30%.

Regardless, today's inflation report is more positive economic news.

Plus there was the whole C19 thing that started happening in Mar 2020 that totally put the economy on it head, as seen on the graph. And as recovery from that has transpired, especially in the later phase when inflation went wild, it makes it even more challenging to get the economy back to a normal balanced level. If they are going to cut interest rates, it's probably going to be in baby steps at this point to help prevent economic whiplash and try and get the economy to react slowly.Yes, I see the increase in FFR preceded a spike in unemployment. As for right now, the slight uptick in unemployment at the far right of the curve is totally expected, it is the entire point of raising the FFR, and since I’m not a wizard who can predict the future, we will just have to wait and see. As I said, unique times.

I'd like to see the inflation curve on that same graph.

I think you’re focusing on the wrong idea. The rise in unemployment is due to the increase in the FFR, not the rate cut. The Fed is simply cutting rates once they see the economy slow and there is always a delay between the FFR going up and unemployment going up. The rate cute isn’t the proximal cause of unemployment going up, it’s an attempt to minimize it, albeit mostly too late.I'm talking about the relationship between the Fed Funds Rate and Unemployment, where pretty much every time the Fed has cut rates, it is immediately proceeded by a spike in unemployment and a recession. I don't see any reason why this time it might be different.

The Prime Rate is the Fed's tool to control inflation, and it's a poor one at best. The economy is so big and so very complex. Models are fine but do not work in this rapidly evolving (changing) economy.I think you’re focusing on the wrong idea. The rise in unemployment is due to the increase in the FFR, not the rate cut. The Fed is simply cutting rates once they see the economy slow and there is always a delay between the FFR going up and unemployment going up. The rate cute isn’t the proximal cause of unemployment going up, it’s an attempt to minimize it, albeit mostly too late.

It’s a blunt instrument for sure.The Prime Rate is the Fed's tool to control inflation, and it's a poor one at best. The economy is so big and so very complex. Models are fine but do not work in this rapidly evolving (changing) economy.

So the like colored lines show the big time delay between the interest rate hikes or cuts and the effect on unemployment. Interest rates go up, causes unemployment to go up. Might take 2-3 years to show the effect. The interest rate hike in Jan 1994 didn't get that reaction in unemployment for some reason until it was raised again in mid 1999, so it's not always going to work the same way it seems. The C19 time period is an animal all its own.I think you’re focusing on the wrong idea. The rise in unemployment is due to the increase in the FFR, not the rate cut. The Fed is simply cutting rates once they see the economy slow and there is always a delay between the FFR going up and unemployment going up. The rate cute isn’t the proximal cause of unemployment going up, it’s an attempt to minimize it, albeit mostly too late.

Last edited:

Similar threads

- Replies

- 23

- Views

- 1K

- Replies

- 67

- Views

- 2K

- Replies

- 29

- Views

- 1K