You’re arguing nonsensical points that aren’t germane to the conversation. All I can tell you is what the The Fed states is their mandate. I’ve seen people argue they suck at hitting their 2% target but I’ve never seen someone actually argue it’s not really 2%. I don’t know how you’d determine that or what to tell you, that’s what they claim, and today when inflation came in at 2.9% and that was closer to 2% than last month’s 3.0%, they and everyone else seemed happy. You reek of troll and so I now choose to stop feeding you. Be well...I'm sorry you chose to view it that way. Sorry I had to spit my coffee out when I heard the "2% Fed mandate". It's just not what happens in practice. Nothing personal.

Am I really the as*hole here for pointing out that economic theory and reality are worlds apart? You don't need an MBA to see that. Everyone on BITOG understands it intuitively.

Btw, you never did mention what sector your business was in.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

*Investors Blog*

- Thread starter Warstud

- Start date

I don't have an Masters, but I already paid for one, and am currently paying for 2 more (wife on her 2nd, kid starting first). Does that buy me an opinion around here?

I don't buy a soft landing. There never has been one. They claim 1990's but the fed funds went from 3 to 6 while the 10 year stayed flat. That wasn't really a fed a cycle, more like a fed tweaking. I will be very happy with a soft landing if it happens, but still not sure how we get any landing while printing 7% of GDP but its uncharted territory

The fed completely controls the yield curve - the 2 years on the front end matches the dot plots and the fed is the largest owner of long bonds. It will uninvert when the fed wants it to - which will be when they figure out they waited too long

If your looking for interest direction watch the Yen or Spreads.

How does this help me. It doesn't. Macro is not the same as the market just like being a savvy saver in your 401K doesn't make you an investor. All interesting topics, but different.

While I am spouting opinions, I agree with @alarmguy that Schwab sucks.

Cash and broad indexes are about all I have stomach for at this point.

I don't buy a soft landing. There never has been one. They claim 1990's but the fed funds went from 3 to 6 while the 10 year stayed flat. That wasn't really a fed a cycle, more like a fed tweaking. I will be very happy with a soft landing if it happens, but still not sure how we get any landing while printing 7% of GDP but its uncharted territory

The fed completely controls the yield curve - the 2 years on the front end matches the dot plots and the fed is the largest owner of long bonds. It will uninvert when the fed wants it to - which will be when they figure out they waited too long

If your looking for interest direction watch the Yen or Spreads.

How does this help me. It doesn't. Macro is not the same as the market just like being a savvy saver in your 401K doesn't make you an investor. All interesting topics, but different.

While I am spouting opinions, I agree with @alarmguy that Schwab sucks.

Cash and broad indexes are about all I have stomach for at this point.

The beauty is one way or another, retrospectively of course, we will find out if this is or isn’t a soft landing. I think the + soft landing is really the time since yield curve inversion has been the greatest amount of time ever to not be in full-recession and minus last week we are still getting good reports. However, who knows, I’m not a wizard and I don’t predict the future, so all I can say it what I think right now looks like, and tomorrow could look totally different.I don't have an Masters, but I already paid for one, and am currently paying for 2 more (wife on her 2nd, kid starting first). Does that buy me an opinion around here?

I don't buy a soft landing. There never has been one. They claim 1990's but the fed funds went from 3 to 6 while the 10 year stayed flat. That wasn't really a fed a cycle, more like a fed tweaking. I will be very happy with a soft landing if it happens, but still not sure how we get any landing while printing 7% of GDP but its uncharted territory

The fed completely controls the yield curve - the 2 years on the front end matches the dot plots and the fed is the largest owner of long bonds. It will uninvert when the fed wants it to - which will be when they figure out they waited too long

If your looking for interest direction watch the Yen or Spreads.

How does this help me. It doesn't. Macro is not the same as the market just like being a savvy saver in your 401K doesn't make you an investor. All interesting topics, but different.

While I am spouting opinions, I agree with @alarmguy that Schwab sucks.

Cash and broad indexes are about all I have stomach for at this point.

- Joined

- Nov 6, 2022

- Messages

- 339

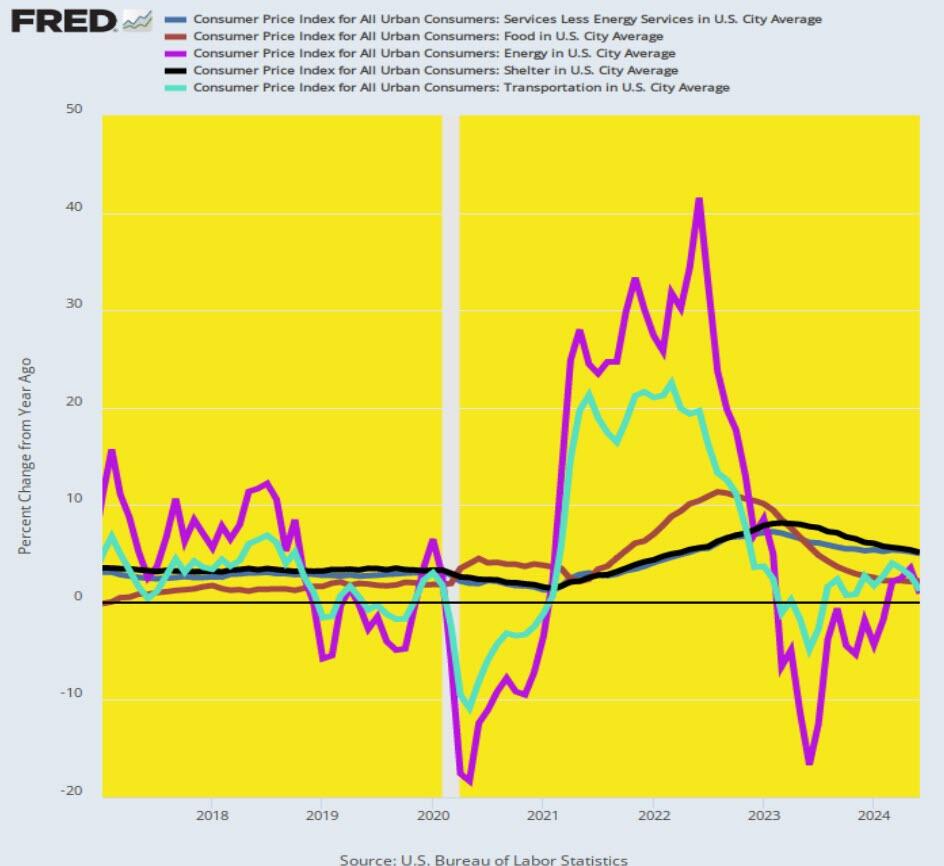

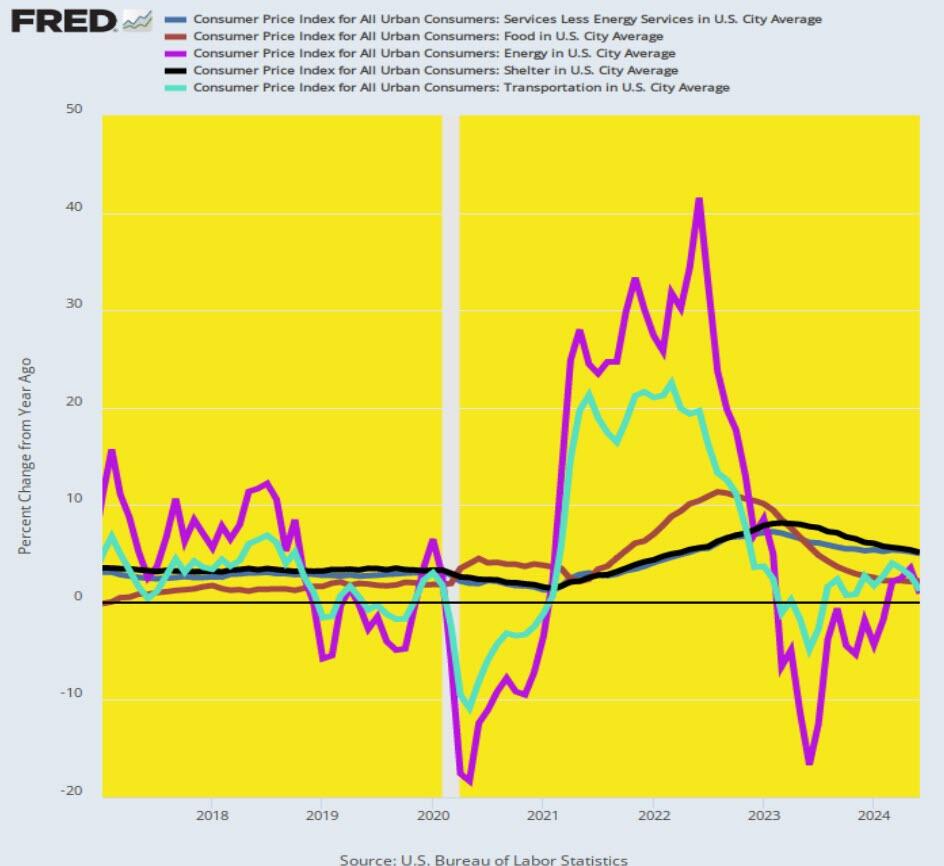

In the past 6 years, the most stable measure of inflation has posted YoY well above 2.00%. 3.7% per annum, to be exact.You’re arguing nonsensical points that aren’t germane to the conversation. All I can tell you is what the The Fed states is their mandate. I’ve seen people argue they suck at hitting their 2% target but I’ve never seen someone actually argue it’s not really 2%. I don’t know how you’d determine that or what to tell you, that’s what they claim, and today when inflation came in at 2.9% and that was closer to 2% than last month’s 3.0%, they and everyone else seemed happy. You reek of troll and so I now choose to stop feeding you. Be well...

So they missed the arbitrary pro-inflation "2.00%" target by nearly 100%. Hmm...

I think reasonable people here on BITOG can look around and see that inflation is not 2.0%/year, not even close. Maybe that's where the disconnect is - actual inflation, versus the textbook definition.

Also, why a soft landing this time? What’s the mechanism? The yield curve is nothing more than investor sentiment about near vs long-term risk. We live in a unique time with social media, more non-professional investors than at any time in the past, and we’ve politicized economics. I can imagine how these could all come together to convince investors the near term was more risky than it really was based on the objective economic measures. This is just my own thoughts…so grain of salt.I don't have an Masters, but I already paid for one, and am currently paying for 2 more (wife on her 2nd, kid starting first). Does that buy me an opinion around here?

I don't buy a soft landing. There never has been one. They claim 1990's but the fed funds went from 3 to 6 while the 10 year stayed flat. That wasn't really a fed a cycle, more like a fed tweaking. I will be very happy with a soft landing if it happens, but still not sure how we get any landing while printing 7% of GDP but its uncharted territory

The fed completely controls the yield curve - the 2 years on the front end matches the dot plots and the fed is the largest owner of long bonds. It will uninvert when the fed wants it to - which will be when they figure out they waited too long

If your looking for interest direction watch the Yen or Spreads.

How does this help me. It doesn't. Macro is not the same as the market just like being a savvy saver in your 401K doesn't make you an investor. All interesting topics, but different.

While I am spouting opinions, I agree with @alarmguy that Schwab sucks.

Cash and broad indexes are about all I have stomach for at this point.

- Joined

- Nov 6, 2022

- Messages

- 339

Take a shot every time someone says "unique time(s)".Also, why a soft landing this time? What’s the mechanism? The yield curve is nothing more than investor sentiment about near vs long-term risk. We live in a unique time with social media, more non-professional investors than at any time in the past, and we’ve politicized economics. I can imagine how these could all come together to convince investors the near term was more risky than it really was based on the objective economic measures. This is just my own thoughts…so grain of salt.

Nothing really unique here. The Fed prints money, they've always printed money, they will continue to print money. The only difference is they're now normalizing it in the classroom with MMT.

I did NOT say inflation was actually 2%. I said THE FED says that’s their goal. What their goal is and them sucking at reaching their goal are two DIFFERENT discussions. You arguing 2% is not their goal and all I can say is that’s what they say their goal is so I don’t know what to tell you.In the past 6 years, the most stable measure of inflation has posted YoY well above 2.00%. 3.7% per annum, to be exact.

So they missed the arbitrary pro-inflation "2.00%" target by nearly 100%. Hmm...

I think reasonable people here on BITOG can look around and see that inflation is not 2.0%/year, not even close. Maybe that's where the disconnect is - actual inflation, versus the textbook definition.

I have no clue either. Define a soft landing? A recession used to be 2 quarters of negative growth, but the NBER said last time that wasn't a recession? If we print our way to happiness is that like hair of the dog for a hangover - the hangover never comes but your liver quits eventually?Also, why a soft landing this time? What’s the mechanism? The yield curve is nothing more than investor sentiment about near vs long-term risk. We live in a unique time with social media, more non-professional investors than at any time in the past, and we’ve politicized economics. I can imagine how these could all come together to convince investors the near term was more risky than it really was based on the objective economic measures. This is just my own thoughts…so grain of salt.

These are all just technical terms anyway. A recession is when your neighbor looses his job. A depression is when you loose yours.

As for the market, this bull is way, way long in the tooth and most of the current gains are multiple expansion, which most often ends poorly. This was all baked in when they printed all that money in 2020 and 2021 so I think we have arrived at that point.

Here ya go. Soft landing.So-called "soft landings" are non-quantifiable, nor has the Fed ever successfully achieved one in the last several decades (whatever that even looks like, because it remains undefined). I made a case for this, accompanied by actual data and charts.

If there is a soft landing in our presence, I'd sure like to see some evidence indicating such. Is it a "soft landing" straight into a recession? I'm confused.

Lastly, folks needn't get all bent out of shape because I disagree with whatever narrative is being pushed here on said "soft landing". That's a red flag indicating to me there is some sort of ulterior motive.

If someone disagrees, fine. State your case and back it up with data.

US Unemployment Rate is at 4.30%, compared to 4.10% last month and 3.50% last year. This is lower than the long term average of 5.69%.

- Joined

- Nov 6, 2022

- Messages

- 339

I have to take people at their word, and judge them against their actions. They can claim their mandate is to grow my 401k by 100% per annum for all I care. At the end of the year, I'm going to look at the statement and decide if they're being truthful.I did NOT say inflation was actually 2%. I said THE FED says that’s their goal. What their goal is and them sucking at reaching their goal are two DIFFERENT discussions. You arguing 2% is not their goal and all I can say is that’s what they say their goal is so I don’t know what to tell you.

- Joined

- Nov 6, 2022

- Messages

- 339

More like a crash landing.Here ya go. Soft landing.

View attachment 235445

Inflation today looks more like the first half of the chart (probably worse) until they decided to change how they would calculate it. A lot like how U-6 unemployment is quoted, when In realty probably half the country is jobless.

Official sources (not conspiracy theory sources) to prove your claim? Link them up.Inflation today looks more like the first half of the chart (probably worse) until they decided to change how they would calculate it.

Friend, you are just adding blabber.More like a crash landing.

Inflation today looks more like the first half of the chart (probably worse) until they decided to change how they would calculate it. A lot like how U-6 unemployment is quoted, when In realty probably half the country is jobless.

You refuse to listen to anything other than what you wanna hear. Are you hoping for a recession? I am not sure what your agenda is, but your points fly in the face of the majority of economists today.

- Joined

- Nov 6, 2022

- Messages

- 339

No, actually I linked my source in that post and it's a good read. You should check it out.Friend, you are just adding blabber.

You refuse to listen to anything other than what you wanna hear. Are you hoping for a recession? I am not sure what your agenda is, but your points fly in the face of the majority of economists today.

Post #4311Official sources (not conspiracy theory sources) to prove your claim? Link them up.

You understand that website is a joke, right?No, actually I linked my source in that post and it's a good read. You should check it out.

Post #4311

Linked after a couple of people quoted it.No, actually I linked my source in that post and it's a good read. You should check it out.

- Joined

- Nov 6, 2022

- Messages

- 339

How do you figure?You understand that website is a joke, right?

Last edited:

I think we need an investor thread devoted to buying or selling shares of company stock.

….

Any site suggestions? I guess easy to search for

….

Any site suggestions? I guess easy to search for

We're still not recovered from a global incident in some ways as significant as past world wars, etc.. How is it not unique - all these underlying factors?Take a shot every time someone says "unique time(s)".

Nothing really unique here. The Fed prints money, they've always printed money, they will continue to print money. The only difference is they're now normalizing it in the classroom with MMT.

@SC Maintenance - NO, lol. Only if you are walking uphill both ways while achieving this - just like us boomers did.I don't have an Masters, but I already paid for one, and am currently paying for 2 more (wife on her 2nd, kid starting first). Does that buy me an opinion around here?

Whew! About 5 years ago I was investigating jumping ship from my lifelong TIAA and Schwab was considered. Feel better now based on these 2 data points.While I am spouting opinions, I agree with @alarmguy that Schwab sucks.

Last edited:

Similar threads

- Replies

- 23

- Views

- 1K

- Replies

- 67

- Views

- 2K

- Replies

- 29

- Views

- 1K