No alternatives + de facto COLLUSION = Monopoly! Gasoline is a low margin/high risk business, though-I still bet that by the Fourth prices back off somewhat.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Gas prices up $1 a gallon just this spring

- Thread starter grampi

- Start date

- Status

- Not open for further replies.

Originally Posted By: Joshua_Skinner

Refineries make very little money. That's why new ones aren't being built.

Refineries make plenty of money. That isn't why new ones aren't built...it's because gov regulations make it too difficult to build new ones...

Refineries make very little money. That's why new ones aren't being built.

Refineries make plenty of money. That isn't why new ones aren't built...it's because gov regulations make it too difficult to build new ones...

Originally Posted By: grampi

Crude prices are still below $60 a barrel and yet gas prices have gone up $1 a gallon just since March...there needs to be an investigation to find out where the gouging is coming from...and this is definitely gouging, and if you don't believe it is, then you must be part of the crooks running the oil industry...

This is the way it always is. Fuel prices always go up in the summertime, especially around Memorial Day when a lot of people are traveling. Now that is of course understandable.

I have been watching this same old game for a long time. Something will happen in the Middle East and fuel prices will IMMEDIATELY go up, even though there was fuel already paid for at the lower price still in the pipeline.

But if for some reason there is a huge boost in available fuel, the price of fuel will NOT immediately decease. It will take a while for that to happen.

Same old, same old.

Crude prices are still below $60 a barrel and yet gas prices have gone up $1 a gallon just since March...there needs to be an investigation to find out where the gouging is coming from...and this is definitely gouging, and if you don't believe it is, then you must be part of the crooks running the oil industry...

This is the way it always is. Fuel prices always go up in the summertime, especially around Memorial Day when a lot of people are traveling. Now that is of course understandable.

I have been watching this same old game for a long time. Something will happen in the Middle East and fuel prices will IMMEDIATELY go up, even though there was fuel already paid for at the lower price still in the pipeline.

But if for some reason there is a huge boost in available fuel, the price of fuel will NOT immediately decease. It will take a while for that to happen.

Same old, same old.

Originally Posted By: grampi

Originally Posted By: Joshua_Skinner

Refineries make very little money. That's why new ones aren't being built.

Refineries make plenty of money. That isn't why new ones aren't built...it's because gov regulations make it too difficult to build new ones...

Want to back that up?

How about this, a little bit of facts for your daily cup of rage. There have not been any news ones as the current ones have been expanded and upgraded so we have a lot of capacity. In fact we have so much capacity refineries have shut down due to lack of demand.

The refinery in Corpus Christi, TX was built to do 1500 Bbl/cd, it now does over 200,000. In Garyville, LA it was set to do 200,000 Garyville, LA, it now does over 500,000. North Pole, AK 22k to over 126k. etc...

Originally Posted By: Joshua_Skinner

Refineries make very little money. That's why new ones aren't being built.

Refineries make plenty of money. That isn't why new ones aren't built...it's because gov regulations make it too difficult to build new ones...

Want to back that up?

How about this, a little bit of facts for your daily cup of rage. There have not been any news ones as the current ones have been expanded and upgraded so we have a lot of capacity. In fact we have so much capacity refineries have shut down due to lack of demand.

The refinery in Corpus Christi, TX was built to do 1500 Bbl/cd, it now does over 200,000. In Garyville, LA it was set to do 200,000 Garyville, LA, it now does over 500,000. North Pole, AK 22k to over 126k. etc...

I never complain about high fuel costs and I burn more than most folks (farm) but healthcare costs don't even get me started!! Yea I have to buy my own insurance/deductible and with what I have paid out the last several yrs in healthcare for wife and I would cover my fuel costs for an eternity. I rarely hear folks on BTOG complain about healthcare costs only fuel. Is it most here are covered fully by an employer and just fuel costs gripes them? I don't feel gouged at all about fuel costs...just healthcare gouging and wondering why we pay for the worlds most expensive healthcare with not the best outcome and but yet VERY reasonable fuel costs.

Originally Posted By: grampi

When have I ever said the gov needs to fix prices or raise wages? I challenge you find one of my posts where I have said that...

Originally Posted By: grampi

"Everyone is worth more than minimum wage, no matter what they do, and no one is worth millions a year, no matter what they do.."

So you are now saying you are against a mandated minimum wage? OK..sounds good

You have said in numerous posts that prices are high with gasoline. You discounted supply and demand and are calling for an investigation. What would you expect to find in that "investigation" (by government). The overwhelming of these "investigations" are fodder for the masses and never show there is price gouging.

When have I ever said the gov needs to fix prices or raise wages? I challenge you find one of my posts where I have said that...

Originally Posted By: grampi

"Everyone is worth more than minimum wage, no matter what they do, and no one is worth millions a year, no matter what they do.."

So you are now saying you are against a mandated minimum wage? OK..sounds good

You have said in numerous posts that prices are high with gasoline. You discounted supply and demand and are calling for an investigation. What would you expect to find in that "investigation" (by government). The overwhelming of these "investigations" are fodder for the masses and never show there is price gouging.

Last edited:

You guys do know a new refinery just opened in North Dakota this year, right? To say no new refineries have been built is no longer correct. It can be done...

http://www.dprefining.com/home

http://www.dprefining.com/home

Originally Posted By: grampi

Crude prices are still below $60 a barrel and yet gas prices have gone up $1 a gallon just since March...there needs to be an investigation to find out where the gouging is coming from...and this is definitely gouging, and if you don't believe it is, then you must be part of the crooks running the oil industry...

What you need to know is the cost of a gallon of gasoline, assume that 1 gallon of crude oil will make 1 gallon of gas, which is not correct because only 0.5-0.6 gallon of gas from 1 gallon of crude oil.

There are 42 gallons in a barrel, so the cost of 1 gallon of crude oil is $60/42 = $1.42. Now add about 30-40 cents a gallon for refining cost, plus Federal and state excise tax plus sale tax(if applicable), plus transportation, plus retail profit. What is the price of a gallon of gas as of now ? So far no oil company profit. The cost so far is about $2.30-2.40 now add oil company profit of about 10% of retail price which is about 25 cents.

For all the works they do oil companies make about 10% profit on revenue, while Federal and State Governments make as much as 20-30% in term of tax and fee from consumers. Look at quarterly reports from all the oil companies, their earning is usually between 6% to 12% at the highest, while Apple earns as much as 40-50% or higher, and some other industries earn as high as 20-30%.

If you think you pay too much for gasoline, check the price in Europe, Japan ... You will be glad to pay what you do now.

Crude prices are still below $60 a barrel and yet gas prices have gone up $1 a gallon just since March...there needs to be an investigation to find out where the gouging is coming from...and this is definitely gouging, and if you don't believe it is, then you must be part of the crooks running the oil industry...

What you need to know is the cost of a gallon of gasoline, assume that 1 gallon of crude oil will make 1 gallon of gas, which is not correct because only 0.5-0.6 gallon of gas from 1 gallon of crude oil.

There are 42 gallons in a barrel, so the cost of 1 gallon of crude oil is $60/42 = $1.42. Now add about 30-40 cents a gallon for refining cost, plus Federal and state excise tax plus sale tax(if applicable), plus transportation, plus retail profit. What is the price of a gallon of gas as of now ? So far no oil company profit. The cost so far is about $2.30-2.40 now add oil company profit of about 10% of retail price which is about 25 cents.

For all the works they do oil companies make about 10% profit on revenue, while Federal and State Governments make as much as 20-30% in term of tax and fee from consumers. Look at quarterly reports from all the oil companies, their earning is usually between 6% to 12% at the highest, while Apple earns as much as 40-50% or higher, and some other industries earn as high as 20-30%.

If you think you pay too much for gasoline, check the price in Europe, Japan ... You will be glad to pay what you do now.

Originally Posted By: Mystic

I have been watching this same old game for a long time. Something will happen in the Middle East and fuel prices will IMMEDIATELY go up, even though there was fuel already paid for at the lower price still in the pipeline.

You're not paying the production cost of the product. You're paying the market cost. This is why you can sell a house that cost $100,000 to build for $200,000. It's also why you can buy a house for $200,000 one year, and have it be worth $100,000 the next year, or $300,000 the year after!

Originally Posted By: Mystic

But if for some reason there is a huge boost in available fuel, the price of fuel will NOT immediately decease.

If supply outpaces demand quick enough, sure it will. In fact, it's been demonstrated quite recently that it will:

http://www.gasbuddy.com/Charts

Look at the decline in price-at-the-pump (national average) from early December 2014 to the end of January 2015: about 75 cents in 6 weeks. It's taken until now, about 18 weeks later, to make that cost back up. In other words, it's taken 3x as long for the price to rise by 75 cents that it took for it to fall by 75 cents.

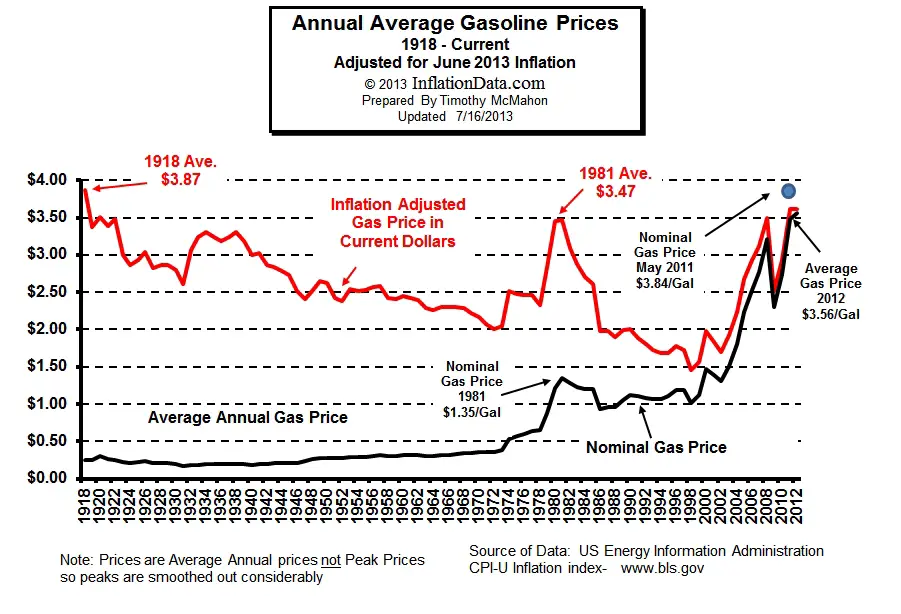

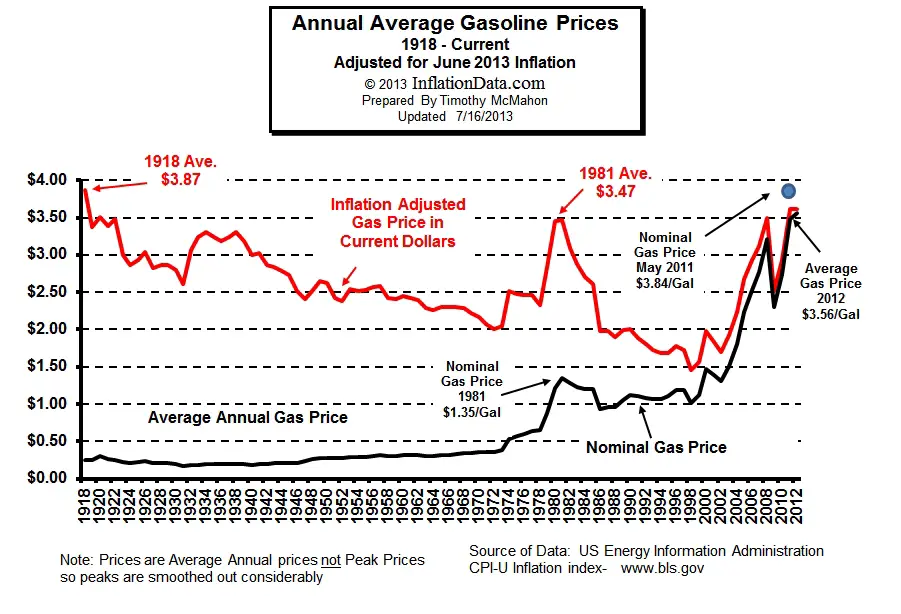

Consider other data, such as this:

This chart also shows the national average of prices at the pump. The price fell in the last third of 2014 about as quickly as it rose during the first third. The spike in prices at the beginning of 2013 mirrors pretty closely the falling-out of prices at the end of 2012. We often comment on how fast gas prices rise, but rarely acknowledge that they also fall nearly just as quickly.

Though it may be beside the point a little bit, I think it's interesting that when you adjust the price at the pump for inflation, we're paying less now than we did at many points during the last century...

I have been watching this same old game for a long time. Something will happen in the Middle East and fuel prices will IMMEDIATELY go up, even though there was fuel already paid for at the lower price still in the pipeline.

You're not paying the production cost of the product. You're paying the market cost. This is why you can sell a house that cost $100,000 to build for $200,000. It's also why you can buy a house for $200,000 one year, and have it be worth $100,000 the next year, or $300,000 the year after!

Originally Posted By: Mystic

But if for some reason there is a huge boost in available fuel, the price of fuel will NOT immediately decease.

If supply outpaces demand quick enough, sure it will. In fact, it's been demonstrated quite recently that it will:

http://www.gasbuddy.com/Charts

Look at the decline in price-at-the-pump (national average) from early December 2014 to the end of January 2015: about 75 cents in 6 weeks. It's taken until now, about 18 weeks later, to make that cost back up. In other words, it's taken 3x as long for the price to rise by 75 cents that it took for it to fall by 75 cents.

Consider other data, such as this:

This chart also shows the national average of prices at the pump. The price fell in the last third of 2014 about as quickly as it rose during the first third. The spike in prices at the beginning of 2013 mirrors pretty closely the falling-out of prices at the end of 2012. We often comment on how fast gas prices rise, but rarely acknowledge that they also fall nearly just as quickly.

Though it may be beside the point a little bit, I think it's interesting that when you adjust the price at the pump for inflation, we're paying less now than we did at many points during the last century...

We burn less fuel as well, modern cars get great mileage.

Originally Posted By: HTSS_TR

Originally Posted By: grampi

Crude prices are still below $60 a barrel and yet gas prices have gone up $1 a gallon just since March...there needs to be an investigation to find out where the gouging is coming from...and this is definitely gouging, and if you don't believe it is, then you must be part of the crooks running the oil industry...

What you need to know is the cost of a gallon of gasoline, assume that 1 gallon of crude oil will make 1 gallon of gas, which is not correct because only 0.5-0.6 gallon of gas from 1 gallon of crude oil.

There are 42 gallons in a barrel, so the cost of 1 gallon of crude oil is $60/42 = $1.42. Now add about 30-40 cents a gallon for refining cost, plus Federal and state excise tax plus sale tax(if applicable), plus transportation, plus retail profit. What is the price of a gallon of gas as of now ? So far no oil company profit. The cost so far is about $2.30-2.40 now add oil company profit of about 10% of retail price which is about 25 cents.

For all the works they do oil companies make about 10% profit on revenue, while Federal and State Governments make as much as 20-30% in term of tax and fee from consumers. Look at quarterly reports from all the oil companies, their earning is usually between 6% to 12% at the highest, while Apple earns as much as 40-50% or higher, and some other industries earn as high as 20-30%.

If you think you pay too much for gasoline, check the price in Europe, Japan ... You will be glad to pay what you do now.

Many of the other countries that have higher gas prices than we do have many of their social services (like healthcare in some cases) paid for out of their gas taxes. Most Americans probably wouldn't mind paying $4 for gas if that also covered their healthcare...

Originally Posted By: grampi

Crude prices are still below $60 a barrel and yet gas prices have gone up $1 a gallon just since March...there needs to be an investigation to find out where the gouging is coming from...and this is definitely gouging, and if you don't believe it is, then you must be part of the crooks running the oil industry...

What you need to know is the cost of a gallon of gasoline, assume that 1 gallon of crude oil will make 1 gallon of gas, which is not correct because only 0.5-0.6 gallon of gas from 1 gallon of crude oil.

There are 42 gallons in a barrel, so the cost of 1 gallon of crude oil is $60/42 = $1.42. Now add about 30-40 cents a gallon for refining cost, plus Federal and state excise tax plus sale tax(if applicable), plus transportation, plus retail profit. What is the price of a gallon of gas as of now ? So far no oil company profit. The cost so far is about $2.30-2.40 now add oil company profit of about 10% of retail price which is about 25 cents.

For all the works they do oil companies make about 10% profit on revenue, while Federal and State Governments make as much as 20-30% in term of tax and fee from consumers. Look at quarterly reports from all the oil companies, their earning is usually between 6% to 12% at the highest, while Apple earns as much as 40-50% or higher, and some other industries earn as high as 20-30%.

If you think you pay too much for gasoline, check the price in Europe, Japan ... You will be glad to pay what you do now.

Many of the other countries that have higher gas prices than we do have many of their social services (like healthcare in some cases) paid for out of their gas taxes. Most Americans probably wouldn't mind paying $4 for gas if that also covered their healthcare...

Originally Posted By: Al

Originally Posted By: grampi

When have I ever said the gov needs to fix prices or raise wages? I challenge you find one of my posts where I have said that...

Originally Posted By: grampi

"Everyone is worth more than minimum wage, no matter what they do, and no one is worth millions a year, no matter what they do.."

So you are now saying you are against a mandated minimum wage? OK..sounds good

You have said in numerous posts that prices are high with gasoline. You discounted supply and demand and are calling for an investigation. What would you expect to find in that "investigation" (by government). The overwhelming of these "investigations" are fodder for the masses and never show there is price gouging.

I still don't see how what I said is saying the gov should mandate $15 an hour minimum wage. Businesses should just pay a living wage, they shouldn't have to be forced to do it. And as far as the gov doing an investigation, no way...even if they found wrong doing within the industry, they'll never do anything about it...look how much revenue it takes in from the sale of gas and diesel...you think it's gonna bite the hand that feeds it?

Originally Posted By: grampi

When have I ever said the gov needs to fix prices or raise wages? I challenge you find one of my posts where I have said that...

Originally Posted By: grampi

"Everyone is worth more than minimum wage, no matter what they do, and no one is worth millions a year, no matter what they do.."

So you are now saying you are against a mandated minimum wage? OK..sounds good

You have said in numerous posts that prices are high with gasoline. You discounted supply and demand and are calling for an investigation. What would you expect to find in that "investigation" (by government). The overwhelming of these "investigations" are fodder for the masses and never show there is price gouging.

I still don't see how what I said is saying the gov should mandate $15 an hour minimum wage. Businesses should just pay a living wage, they shouldn't have to be forced to do it. And as far as the gov doing an investigation, no way...even if they found wrong doing within the industry, they'll never do anything about it...look how much revenue it takes in from the sale of gas and diesel...you think it's gonna bite the hand that feeds it?

^^^That would be funny if it wasn't really a well intended comment. (Actually the earlier post, but either one is ridiculous.

It seems a bit disingenuous to rail about high prices out one side of your mouth and yet propose more taxation out the other...

It seems a bit disingenuous to rail about high prices out one side of your mouth and yet propose more taxation out the other...

Last edited:

Originally Posted By: grampi

Originally Posted By: Joshua_Skinner

Refineries make very little money. That's why new ones aren't being built.

Refineries make plenty of money. That isn't why new ones aren't built...it's because gov regulations make it too difficult to build new ones...

Don't forget NIMBY syndrome.

Originally Posted By: Joshua_Skinner

Refineries make very little money. That's why new ones aren't being built.

Refineries make plenty of money. That isn't why new ones aren't built...it's because gov regulations make it too difficult to build new ones...

Don't forget NIMBY syndrome.

Originally Posted By: grampi

Many of the other countries that have higher gas prices than we do have many of their social services (like healthcare in some cases) paid for out of their gas taxes. Most Americans probably wouldn't mind paying $4 for gas if that also covered their healthcare...

Average regular in Orange County, California is $3.75/gal, some stations around my area is close to $4 and above $4 just last week.

We are paying about 50-80 cents more than Ohio average and we don't complain about oil industry greedy, because we know that the higher price we pay is the result of higher state tax and fees, also we have special formula that costs more to produce.

I'm very glad that we have plentiful gasoline supply that I can buy anytime 7 days a week, and the oil industry is making a good profit (around 8-12%) so that they have money to explore for new oil fields.

Many of the other countries that have higher gas prices than we do have many of their social services (like healthcare in some cases) paid for out of their gas taxes. Most Americans probably wouldn't mind paying $4 for gas if that also covered their healthcare...

Average regular in Orange County, California is $3.75/gal, some stations around my area is close to $4 and above $4 just last week.

We are paying about 50-80 cents more than Ohio average and we don't complain about oil industry greedy, because we know that the higher price we pay is the result of higher state tax and fees, also we have special formula that costs more to produce.

I'm very glad that we have plentiful gasoline supply that I can buy anytime 7 days a week, and the oil industry is making a good profit (around 8-12%) so that they have money to explore for new oil fields.

Originally Posted By: SteveSRT8

^^^That would be funny if it wasn't really a well intended comment. (Actually the earlier post, but either one is ridiculous.

It seems a bit disingenuous to rail about high prices out one side of your mouth and yet propose more taxation out the other...

Where do you guys come up with this stuff? Where did I propose more taxation?

^^^That would be funny if it wasn't really a well intended comment. (Actually the earlier post, but either one is ridiculous.

It seems a bit disingenuous to rail about high prices out one side of your mouth and yet propose more taxation out the other...

Where do you guys come up with this stuff? Where did I propose more taxation?

Originally Posted By: Trajan

Originally Posted By: grampi

Originally Posted By: Joshua_Skinner

Refineries make very little money. That's why new ones aren't being built.

Refineries make plenty of money. That isn't why new ones aren't built...it's because gov regulations make it too difficult to build new ones...

Don't forget NIMBY syndrome.

That falls in with the tree huggers, which is what drives the gov regulations that prevent the building of new refineries...

Originally Posted By: grampi

Originally Posted By: Joshua_Skinner

Refineries make very little money. That's why new ones aren't being built.

Refineries make plenty of money. That isn't why new ones aren't built...it's because gov regulations make it too difficult to build new ones...

Don't forget NIMBY syndrome.

That falls in with the tree huggers, which is what drives the gov regulations that prevent the building of new refineries...

Originally Posted By: grampi

Most Americans probably wouldn't mind paying $4 for gas if that also covered their healthcare...

Most Americans probably wouldn't mind paying $4 for gas if that also covered their healthcare...

Originally Posted By: grampi

That falls in with the tree huggers, which is what drives the gov regulations that prevent the building of new refineries...

If the regs were that bad, we'd shut up shop and import finished gasoline from overseas. But we don't in any great numbers.

That falls in with the tree huggers, which is what drives the gov regulations that prevent the building of new refineries...

If the regs were that bad, we'd shut up shop and import finished gasoline from overseas. But we don't in any great numbers.

- Status

- Not open for further replies.

Similar threads

- Replies

- 74

- Views

- 13K

- Replies

- 12

- Views

- 302

- Replies

- 14

- Views

- 646

- Replies

- 15

- Views

- 579