JHZR2

Staff member

DO NOT MAKE THIS A POLITICAL OR GOVERNMENTAL DISCUSSION.

I was going through my latest pay stub, because I had worked some extra reimbursible hours and wanted to see the result. Im salaried so dont get extra bonus pay or time and a half or anything, but since I had these hours, wanted to see. I was surprised at the tiny amount of extra money I got considering what I was paid.

Which is prompting me to go back and re evaluate all my exemptions and filing statuses for my taxes. Its early in the new year, so it is probably a good time for everyone to do so.

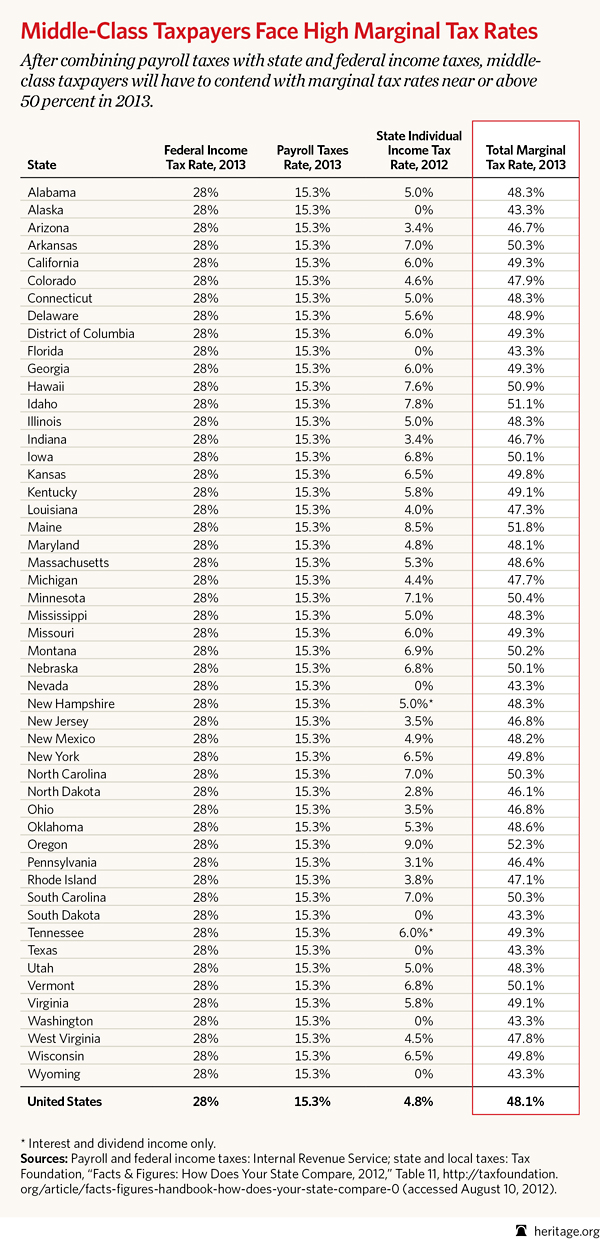

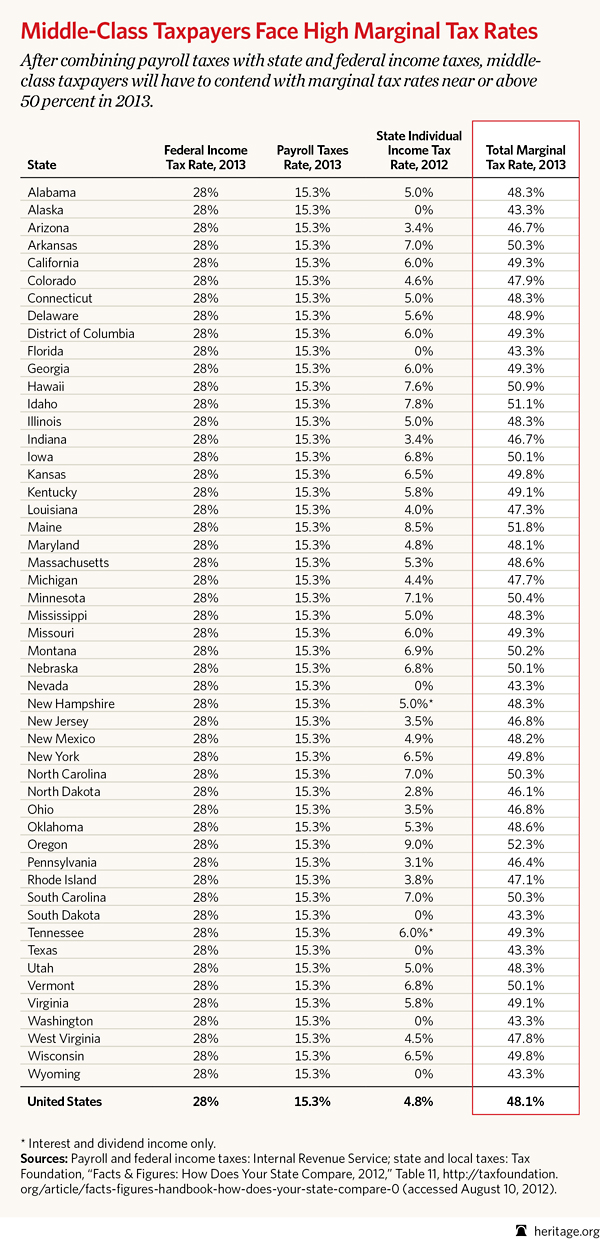

A cursory search gave some info into how much total tax were roughly paying, if we do pay taxes. I found it interesting because we so often talk about federal tax, which is one percentage and a big one, but there are more to consider, which at least I personally dont think of (and Ihave a city wage tax to pay too, on top of these).

There are a few marginal tax rate calculators online that you can use, as well as the IRS tool. May be worth a shot looking at it, especially if your life has changed, as ours has. The percentages in the image are just an example of what is the rough payment point. LOTS of variables can make these numbers FAR different.

Probably a good time for all, especially if you got a big refund back last year and didnt make any adjustments, or are expecting a big refund this year... And of course, the life changes...

End of this public service announcement.

I was going through my latest pay stub, because I had worked some extra reimbursible hours and wanted to see the result. Im salaried so dont get extra bonus pay or time and a half or anything, but since I had these hours, wanted to see. I was surprised at the tiny amount of extra money I got considering what I was paid.

Which is prompting me to go back and re evaluate all my exemptions and filing statuses for my taxes. Its early in the new year, so it is probably a good time for everyone to do so.

A cursory search gave some info into how much total tax were roughly paying, if we do pay taxes. I found it interesting because we so often talk about federal tax, which is one percentage and a big one, but there are more to consider, which at least I personally dont think of (and Ihave a city wage tax to pay too, on top of these).

There are a few marginal tax rate calculators online that you can use, as well as the IRS tool. May be worth a shot looking at it, especially if your life has changed, as ours has. The percentages in the image are just an example of what is the rough payment point. LOTS of variables can make these numbers FAR different.

Probably a good time for all, especially if you got a big refund back last year and didnt make any adjustments, or are expecting a big refund this year... And of course, the life changes...

End of this public service announcement.