Well that's helpful...Gains.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

*Investors Blog*

- Thread starter Warstud

- Start date

Many thought that In the early 1930's but countries like Canada made trade deals of which the entire group specifically excluded the US. It is infinitely cheaper to do that rather than sink the capital into the US which could remove tariffs at any time or get taxed into oblivion because tariffs receipts have fallen through the floor. We truly are on the verge of a huge recession all for a 1‰* bump in manufacturing payrolls.The tariffs will run their course in time. Almost every country needs the USA more than we need them. Canada is a like a poodle barking and biting at a pit bull. Some will end earlier, some will end later, but they will level out and volatility will decrease. Also, three Fed cuts are now much more likely through the rest of the year. After a tumultuous spring/summer, I look forward to a profitable fall/ winter and spring of 2026.

*The projected increase in manufacturing jobs has been to increase US manufacturing from 8%-9%.

They did and people lost their jobs in industries which were affected. Farmers in particular were hit hard so tariff collected was used to support the farmers who couldn't make $$ in their exports.Then why didn't prices go up in the previous term when tariffs were introduced??

https://www.federalreserve.gov/econres/feds/files/2019086pap.pdf

Last edited:

Smoot Hawley is always brought up but its not applicable.Many thought that In the early 1930's but countries like Canada made trade deals of which the entire group specifically excluded the US. It is infinitely cheaper to do that rather than sink the capital into the US which could remove tariffs at any time or get taxed into oblivion because tariffs receipts have fallen through the floor. We truly are on the verge of a huge recession all for a 1‰* bump in manufacturing payrolls.

*The projected increase in manufacturing jobs has been to increase US manufacturing from 8%-9%.

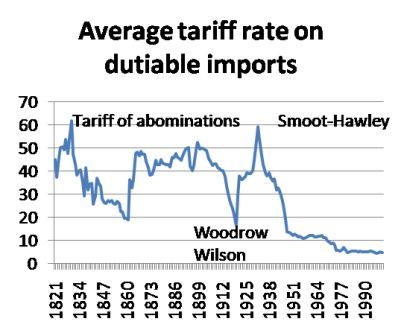

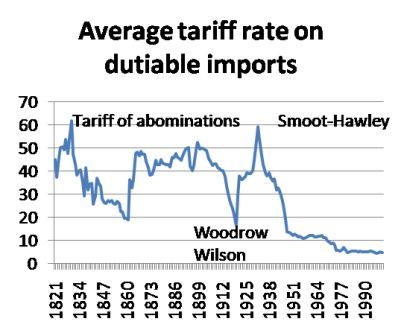

- Smoot Hawley happened in the great depression, when trade was already collapsing.

- Smoot Hawley happened when the US was a massive net exporter (seller). Now were net importer (buyer)

- Smoot Hawley happened under the gold standard, so currencies were fixed to gold - unless purposely devalued. Trade balanced automatically back then by gold coming and going, and currency adjustment which doesn't happen now.

The current issue is a function of fiat currency, too much debt, and a system designed to win the cold war. It should have ended in 1992.

No idea what tarriff's do now. But Smoot Hawley is not even close to applicable.

Smoot Hawley is always brought up but its not applicable.

Comparing to Smoot Hawley isn't even close to applicable, because the US is currently the world's customer. They all say there going to sell amongst themselves, but there are no net buyers, only net sellers. So which country is going to be the rube and ruin there own economy to buy stuff from everyone else?

- Smoot Hawley happened in the great depression, when trade was already collapsing.

- Smoot Hawley happened when the US was a massive net exporter (seller). Now were net importer (buyer)

- Smoot Hawley happened under the gold standard, so currencies were fixed to gold - unless purposely devalued. Trade balanced automatically back then by gold coming and going, and currency adjustment which doesn't happen now.

The current issue is a function of fiat currency, too much debt, and a system designed to win the cold war. It should have ended in 1992.

No idea what tarriff's do now. But Smoot Hawley is not even close to applicable.

Between WW1 and WW2 there was a nominal surplus. I don't know if I would call it "massive". US farmers are going to take it on the chin. Again.

"History never repeats itself, but it does often rhyme." - M. Twain.

I prefer to say a wake up call that the USA will no longer be victimized by the rest of the w

FWIW the GDP of US is about$30 trillion while rest of World is $110 Trillion. Eu and Canada is about $22 Trillion. US right now yes is the global economic power regarding trade but current events would indicate a shift to a more closed economy for the US and a major shift in world regarding alliances away from the US as a trusted trading partner. And I do think fiat currency was/is a big issue. Remember Ron Paul's thoughts on the economy and the FED? He wrote a great book on End The Fed, I really should read it again.Smoot Hawley is always brought up but its not applicable.

Comparing to Smoot Hawley isn't even close to applicable, because the US is currently the world's customer. They all say there going to sell amongst themselves, but there are no net buyers, only net sellers. So which country is going to be the rube and ruin there own economy to buy stuff from everyone else?

- Smoot Hawley happened in the great depression, when trade was already collapsing.

- Smoot Hawley happened when the US was a massive net exporter (seller). Now were net importer (buyer)

- Smoot Hawley happened under the gold standard, so currencies were fixed to gold - unless purposely devalued. Trade balanced automatically back then by gold coming and going, and currency adjustment which doesn't happen now.

The current issue is a function of fiat currency, too much debt, and a system designed to win the cold war. It should have ended in 1992.

No idea what tarriff's do now. But Smoot Hawley is not even close to applicable.

As the population starts checking their 401k's, Roth's this weekend which for the majority has been on autopilot.

The sad lesson to be learned for some is the meaning of REALIZED GAINS AND LOSSES vs. UNREALIZED GAINS AND LOSSES

Where it stops we do not know

I should have known better, I was about to pull the trigger 2 months ago. Gave up the last years gains and ready to pull the plug at anytime (maybe) All depends on when this may or may not stop and my feelings that I trust but sometimes dont act.

Markets hate uncertainty and I knew that in Jan, uncertainty was on its way! Ugh! It's so sad I am laughing.

It's going to be a wild ride, never say never, we got used to living on debt. Anything can happen.

The sad lesson to be learned for some is the meaning of REALIZED GAINS AND LOSSES vs. UNREALIZED GAINS AND LOSSES

Where it stops we do not know

I should have known better, I was about to pull the trigger 2 months ago. Gave up the last years gains and ready to pull the plug at anytime (maybe) All depends on when this may or may not stop and my feelings that I trust but sometimes dont act.

Markets hate uncertainty and I knew that in Jan, uncertainty was on its way! Ugh! It's so sad I am laughing.

It's going to be a wild ride, never say never, we got used to living on debt. Anything can happen.

As the population starts checking their 401k's,

The quarterly email about TSP statements being available went out this morning.

Obviously it depends on a lot of things, but age is a big one. I'm 100% domestic stock in my 401 and IRA and not sweating the swaths of red that have arrived on the home pages. I'm 34 and have decades to go. In the meantime, contributions continue during the flash sale which should mature nicely. I still try not to look but I also know in my case it really doesn't matter at this point. My brokerage account, though, had a noticeable sell-off a couple of weeks agoAs the population starts checking their 401k's, Roth's this weekend which for the majority has been on autopilot.

The sad lesson to be learned for some is the meaning of REALIZED GAINS AND LOSSES vs. UNREALIZED GAINS AND LOSSES

Where it stops we do not know

I should have known better, I was about to pull the trigger 2 months ago. Gave up the last years gains and ready to pull the plug at anytime (maybe) All depends on when this may or may not stop and my feelings that I trust but sometimes dont act.

Markets hate uncertainty and I knew that in Jan, uncertainty was on its way! Ugh! It's so sad I am laughing.

It's going to be a wild ride, never say never, we got used to living on debt. Anything can happen.

It sounds like my boss may be extending his tenure a little later than expected due to all of this prior to retirement...or so he says.

Great point and you are correct. Yes age is a big one.Obviously it depends on a lot of things, but age is a big one. I'm 100% domestic stock in my 401 and IRA and not sweating the swaths of red that have arrived on the home pages. I'm 34 and have decades to go. In the meantime, contributions continue during the flash sale which should mature nicely. I still try not to look but I also know in my case it really doesn't matter at this point. My brokerage account, though, had a noticeable sell-off a couple of weeks ago

It sounds like my boss may be extending his tenure a little later than expected due to all of this prior to retirement...or so he says.

Me older, Im in good shape. I just gave up some unrealized gains. That isnt fun giving it up because I had so much fun building it up. It's not going to affect my life other than my self esteem because I was doing really well above the index funds.

I think part of me is thinking more about the young. My children, one just bought a house weeks ago.

The other is getting prepared to sell theirs and upgrading to a much larger. What if their good jobs take a hit?

In times of uncertainty, ok I think to much sometimes. However, we have become used to government bailouts all the time. Well with 36 Trillion in debt, and now a possible global meltdown. Im concerned for the young families who depend on their jobs. Never say never until the results are known. This could be, or very possibly not be, when the house of cards comes tumbling down world wide.

BTW- this is just this mornings feeling when I woke up and couldnt go back to sleep. It was supposed to be a good morning, my wife and I have Best Buy delivering a new refrigerator and new Sony TV (good one) to our daughter's new house as a gift. So I was feeling good, then looked at the news. China puts a 35% tariff on us, Market Futures in the toilet, AGAIN

It is people in your age group that I concern myself with. My kids, Im proud of and this would slam them at the worst time if their companies are affected. Both international companies.

My wife, who deals daily (her job is very safe) with international merchandise. Hundreds? Thousands? of orders that havent shipped are warned they may have to be re-quoted. Kind of creepy, because of the "unknown"

Last edited:

The U.S. economy has relied on periodic adjustments for how long? At least since the 1930's. In my 1970's economics class they still taught this principle. I'm not sure why so many are playing Chicken Little and exclaiming "the sky is falling". Since I operate as a minimalist, I don't have to cut back much at all. Others might have to pare down their luxuries a bit. Maybe the next new home only has 3 bathrooms, not 5. May have to put up with unheated steering wheel in the next vehicle? Pare down the television subscriptions a bit?  .

.

Nearing retirement, I followed the advice to avoid greed and change my portfolio to safer, less aggressive, less risky options. I'm o.k. with all that is going on. Sorry - trying to not be condescending, but it is so much fun.

Nearing retirement, I followed the advice to avoid greed and change my portfolio to safer, less aggressive, less risky options. I'm o.k. with all that is going on. Sorry - trying to not be condescending, but it is so much fun.

Zee09

$200 Site Donor 2023

- Joined

- May 5, 2018

- Messages

- 20,871

I got a ping at 6:20 AM that I got TSLA and as soon as I grabbed the phone I was down $480. And 1 minute later I was down $1400 and later I was up $365 so I flipped it and a few minutes later bought it back for about $3 less a share and now I am on hold... crazy days continue.

I know about your house becaus some people are foolish enough to post pictures on oil forumsI got lucky with my house. No one knew that property values around here would increase so much or everyone would have bought, right?

I bought this house because I wanted to live here and worked hard to pay it off. I took my lumps. It took a long time, no vacations, no nothing. Every extra penny went into the house or long term investments. That's what being homeless can teach you.

By the way, I wish you the best in your investing and long term financial security.

I am curious how you know about my house. There's no carport in my main home...

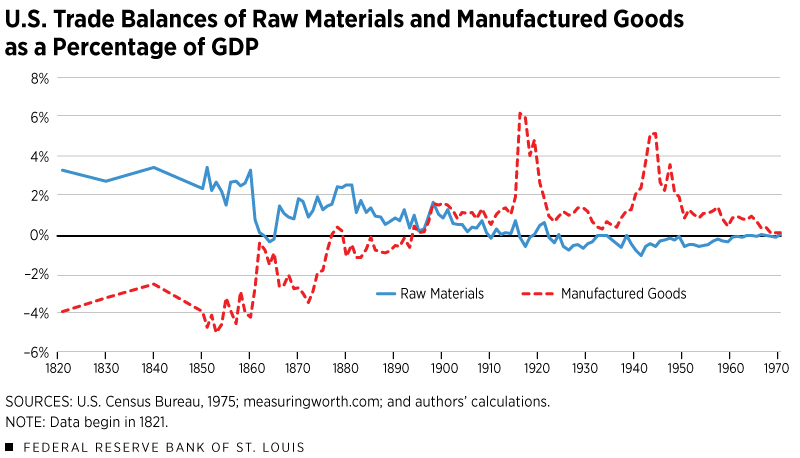

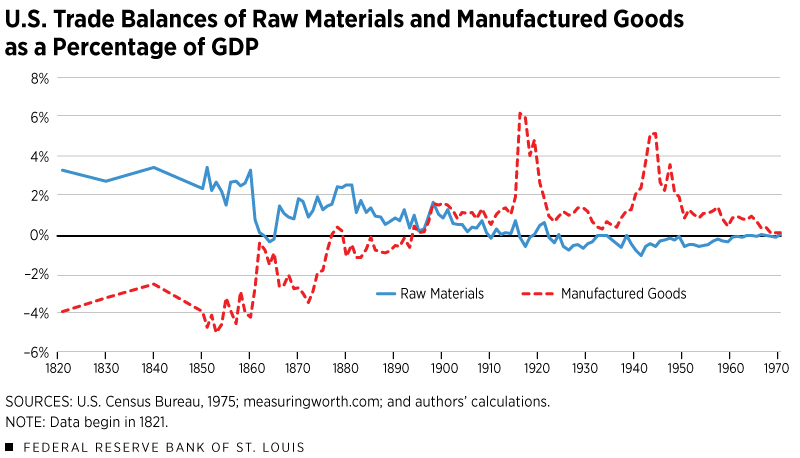

Excellent chart. So in 1910-1920 we had a trade surplus of 1 to 1.5% of GDP - which would be between 1 and 1.5 Trillion dollars comparitively to put it into perspective. So lets just use 1 Trillion surplus, vs 2024 deficit of $900B. Or a $1.9Trillion delta. So if we were running at the 1910 to 1920 rate, we would add 6% growth to GDP.

Between WW1 and WW2 there was a nominal surplus. I don't know if I would call it "massive". US farmers are going to take it on the chin. Again.

"History never repeats itself, but it does often rhyme." - M. Twain.

Again, not for or against tariff's - but the current trade deficit is not sustainable

Then why didn't prices go up in the previous term when tariffs were introduced??

Because you are already paying a made in USA price on everything, even if the item is made in a third world country. Did the price of Toyota trucks go down when Toyota moved the factory from Texas to Mexico? When you see the price tags on those Cadillacs made in Mexico, does the price reflect this? Of course not! That is why the stock market is reacting the way that it is. It's because investors know that this is going to squeeze profits, because when companies outsource or move factories to Mexico, China, etc they pocket the difference. They don't pass this onto the consumer. The only exception that I can think of is Harbor Freight who sometimes does pass the savings onto the consumer.

It was a good book but what RP failed or chose to not acknowledge is that throughout history a gold standard did not prevent sovereigns from debasing their gold-backed currency. Ending the Fed is not a panacea which will all of a sudden "fix" the economy.FWIW the GDP of US is about$30 trillion while rest of World is $110 Trillion. Eu and Canada is about $22 Trillion. US right now yes is the global economic power regarding trade but current events would indicate a shift to a more closed economy for the US and a major shift in world regarding alliances away from the US as a trusted trading partner. And I do think fiat currency was/is a big issue. Remember Ron Paul's thoughts on the economy and the FED? He wrote a great book on End The Fed, I really should read it again.

From a historical perspective the US, Pre-Fed, was incredibly lucky by having the good fortune of being a new country undergoing relatively non-violent territorial expansion during the industrial revolution. Recessions were severe but short because labor kept flooding US shores and people moved westward to build businesses.

The "problem" is one of competition via the supply of labor. You can't pay high wages to produce lower ordered/uncompetitive goods. They won't be purchased and the market will find an alternative unless you try to force, via violence, the consumer to buy these goods at which point everyone is poorer for it. Misery for all rather than misery for some!

Looks like people are still panic selling.

There's plenty of papers out there on how tariffs will have no impact on the deficit.Excellent chart. So in 1910-1920 we had a trade surplus of 1 to 1.5% of GDP - which would be between 1 and 1.5 Trillion dollars comparitively to put it into perspective. So lets just use 1 Trillion surplus, vs 2024 deficit of $900B. Or a $1.9Trillion delta. So if we were running at the 1910 to 1920 rate, we would add 6% growth to GDP.

Again, not for or against tariff's - but the current trade deficit is not sustainable

Well if tariff revenue was applied directly to deficit paydown would not that impact the deficit?There's plenty of papers out there on how tariffs will have no impact on the deficit.

Capitalism and competition, exactly. The drive to lower prodution costs of goods/services moved manufacturing offshore/elsewhere, to repatriate factories back can only cause costs to skyrocket. Question is will the consumer want to pay for this?It was a good book but what RP failed or chose to not acknowledge is that throughout history a gold standard did not prevent sovereigns from debasing their gold-backed currency. Ending the Fed is not a panacea which will all of a sudden "fix" the economy.

From a historical perspective the US, Pre-Fed, was incredibly lucky by having the good fortune of being a new country undergoing relatively non-violent territorial expansion during the industrial revolution. Recessions were severe but short because labor kept flooding US shores and people moved westward to build businesses.

The "problem" is one of competition via the supply of labor. You can't pay high wages to produce lower ordered/uncompetitive goods. They won't be purchased and the market will find an alternative unless you try to force, via violence, the consumer to buy these goods at which point everyone is poorer for it. Misery for all rather than misery for some!

Similar threads

- Replies

- 23

- Views

- 1K

- Replies

- 67

- Views

- 2K

- Replies

- 29

- Views

- 1K