Another surprising inflation report; the soft landing continues. The market will like the numbers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

*Investors Blog*

- Thread starter Warstud

- Start date

- Joined

- Nov 6, 2022

- Messages

- 339

Nothing "soft" about this landing. PPI is cooked, everyone knows that. Look around, does it look like things are getting cheaper??Another surprising inflation report; the soft landing continues. The market will like the numbers.

Things in general getting cheaper is called deflation and that is worse than hyperinflation. If that’s your expectation, it’s the wrong expectation. Also, wage growth is outpacing inflation now and I can verify that as a business owner. Some individual items will of course get cheaper but the basket of goods is not as a whole. This IS a soft-landing by the official definition.Nothing "soft" about this landing. PPI is cooked, everyone knows that. Look around, does it look like things are getting cheaper??

- Joined

- Nov 6, 2022

- Messages

- 339

Deflation is worse than hyperinflation? How so?Things in general getting cheaper is called deflation and that is worse than hyperinflation. If that’s your expectation, it’s the wrong expectation. Also, wage growth is outpacing inflation now and I can verify that as a business owner. Some individual items will of course get cheaper but the basket of goods is not as a whole. This IS a soft-landing by the official definition.

Wage growth? There's no wage growth in America. Real wages have been stagnant or on the decline for decades now. If there's any real wage growth here it would be so infinitesimally small that it could be mistaken for nonexistent.

Deflation causes a crisis of confidence whereby all your assets become less valuable over time and it causes people to further reduce spending (why would you buy something today that may be worth less tomorrow?). This contracts the economy and it runs the risk of severe recession and the deflationary spiral. What we have experienced since the height of hyperinflation has been disinflation. This is when the rate at which inflation goes up decreases, but inflation is still positive, things are still getting more expensive over time, just not as quickly. The soft landing is disinflation to normal inflation levels WITHOUT deflation. One of the reasons the Fed targets 2% inflation is to give a buffer so inflation doesn't go to zero or negative because that is bad.Deflation is worse than hyperinflation? How so?

- Joined

- Nov 6, 2022

- Messages

- 339

There's a lot of handwaving going on here, and not exactly economic analysis. Not trying to start a pissing match but this is just wrong.Deflation causes a crisis of confidence whereby all your assets become less valuable over time and it causes people to further reduce spending (why would you buy something today that may be worth less tomorrow?). This contracts the economy and it runs the risk of severe recession and the deflationary spiral. What we have experienced since the height of hyperinflation has been disinflation. This is when the rate at which inflation goes up decreases, but inflation is still positive, things are still getting more expensive over time, just not as quickly. The soft landing is disinflation to normal inflation levels WITHOUT deflation. One of the reasons the Fed targets 2% inflation is to give a buffer so inflation doesn't go to zero or negative because that is bad.

There is no crisis of confidence here. Uncle Sam subscribes to MMT and the rubes just keep on buying USD. In reality, assets are basically experiencing a watered-down version of hyperinflation. That is not good. That means the dollar is actually losing its intrinsic value. That puts it at risk of losing its world reserve status.

Among other things, this is manifesting itself as a cryptocurrency bull market. People would rather pay $60,000 for 1 bitcoin than hold that as cash or put it into real estate, or some other tangible asset like bonds or money market accounts, or even the stock market...

I'm not really sure what the Fed is targeting these days other than the stock market. That's their only real mandate as far as I can tell.the Fed targets 2% inflation is to give a buffer so inflation doesn't go to zero or negative because that is bad.

Last edited:

That’s NOT what I said. I said DEFLATION is a crisis of confidence, I was explaining why that is bad, and we are NOT in deflation and so your comment is just meaningless. This is not my opinion, this is written in every economics textbook, it has plenty of data to support it. If you don’t like it, go write an economics paper challenging this conventional wisdom and when you change the minds of a majority of economists, I’ll take you seriously.There's a lot of handwaving going on here, and not exactly economic analysis. Not trying to start a pissing match but this is just wrong.

There is no crisis of confidence here. Uncle Sam subscribes to MMT and the rubes just keep on buying USD. In reality, assets are basically experiencing a watered-down version of hyperinflation. That is not good. That means the dollar is actually losing its intrinsic value. That puts it at risk of losing its world reserve status.

Among other things, this is manifesting itself as a cryptocurrency bull market. People would rather pay $60,000 for 1 bitcoin than hold that as cash or put it into real estate, or some other tangible asset like bonds or money market accounts, or even the stock market...

I’m just telling you why, not making any claims that they’re good at it. You clearly want some fight here and I’m just relaying some basic information. Deflations IS bad. Go read about it, learn about it, there is a TON written about it.I'm not really sure what the Fed is targeting these days other than the stock market. That's their only real mandate as far as I can tell.

- Joined

- Nov 6, 2022

- Messages

- 339

Which economics textbooks have you read? Serious question.That’s NOT what I said. I said DEFLATION is a crisis of confidence, I was explaining why that is bad, and we are NOT in deflation and so your comment is just meaningless. This is not my opinion, this is written in every economics textbook, it has plenty of data to support it. If you don’t like it, go write an economics paper challenging this conventional wisdom and when you change the minds of a majority of economists, I’ll take you seriously.

I have, thank you. The problem here is a little deflation isn't as monumentally bad as you claim. The dollar doesn't just intrinsically grow in value in perpetuity because it's afforded some ethereal pixie dust magic bean status. That is simply an artifact of abandoning the gold standard. To have that expectation is to be missing the forest for the trees, imo.I’m just telling you why, not making any claims that they’re good at it. You clearly want some fight here and I’m just relaying some basic information. Deflations IS bad. Go read about it, learn about it, there is a TON written about it.

I’m ⅔ my way through my MBA at UMass Amherst but here you go if you want to have a pee pee contest, sure, here’s mine. Somewhere in that course Economic Analysis for Managers, I read an economics textbook. In case you’re wondering, got an A in Corporate Finance too, just waiting for the grade to be submitted. There you go, I showed you mine...Which economics textbooks have you read? Serious question.

I have, thank you. The problem here is a little deflation isn't as monumentally bad as you claim. The dollar doesn't just intrinsically grow in value in perpetuity because it's afforded some ethereal pixie dust magic bean status. That is simply an artifact of abandoning the gold standard.

- Joined

- Nov 6, 2022

- Messages

- 339

That's awesome, congrats on the MBA.I’m ⅔ my way through my MBA at UMass Amherst but here you go if you want to have a pee pee contest, sure, here’s mine. Somewhere in that course Economic Analysis for Managers, I read an economics textbook. In case you’re wondering, got an A in Corporate Finance too, just waiting for the grade to be submitted. There you go, I showed you mine...

I enjoy the discussion, no pissing match needed. I simply am not seeing the same "soft landing" that you are. In fact everywhere I look, there are massive layoffs, eg in the tech sector.

I'm not going to dig up my transcripts, I wouldn't even know how to get them at this point that's so far in the past. I'll let my posts speak for themselves. If you are in fact pursuing an MBA, I know that you'll recognize I'm not bs'ing here.

Which economics textbooks have you read? Serious question.

I have, thank you. The problem here is a little deflation isn't as monumentally bad as you claim. The dollar doesn't just intrinsically grow in value in perpetuity because it's afforded some ethereal pixie dust magic bean status. That is simply an artifact of abandoning the gold standard.

Fair enough, remember too, not all sectors are affected the same way. Tech may take a hit while healthcare gets an offsetting bump. You have to take the economy as a whole.That's awesome, congrats on the MBA.

I enjoy the discussion, no pissing match needed. I simply am not seeing the same "soft landing" that you are. In fact everywhere I look, there are massive layoffs, eg in the tech sector.

I'm not going to dig up my transcripts, I wouldn't even know how to get them at this point that's so far in the past. I'll let my posts speak for themselves. If you are in fact pursuing an MBA, I know that you'll recognize I'm not bs'ing here.

- Joined

- Nov 6, 2022

- Messages

- 339

Indeed. But the tech sector is what's driving the stock market - the so called Magnificent 7 - and why we just had one of the worst few days on record since Black Monday. The Fed are just flying by wire, which is why the dot plot changes pretty much from one week to the next. They're really just making it up as they go, imo. Jerome Powell isn't even an economist. He's a lawyer for god's sake.Fair enough, remember too, not all sectors are affected the same way. Tech may take a hit while healthcare gets an offsetting bump. You have to take the economy as a whole.

What sector is your business in?

I minored in Econ at San Jose State. I can tell you @PWMDMD is giving you straight up Economics theory.Which economics textbooks have you read? Serious question.

In relatively simple English, a soft landing is a cyclical slowdown in economic growth that ends without a period of outright recession.

In more Economic terms:

An economic soft landing is when a central bank, like the Federal Reserve, manages to lower inflation and cool down a strong economy without causing a significant decline in economic activity, or a recession. The term implies that the economy has returned to growth without a period of severe recession.

This is exactly what we are seeing. Continued strong employment with a gradual slowing of the rate of inflation. This thread's original post, not so long ago, posted the likelihood of recession in America and worldwide. This was the general consensus; the rest of the world suffered much more that the US.

- Joined

- Nov 6, 2022

- Messages

- 339

Except for that whole inverted yield curve thing.This is exactly what we are seeing. Continued strong employment with a gradual slowing of the rate of inflation. This thread's original post, not so long ago, posted the likelihood of recession in America and worldwide. This was the general consensus; the rest of the world suffered much more that the US.

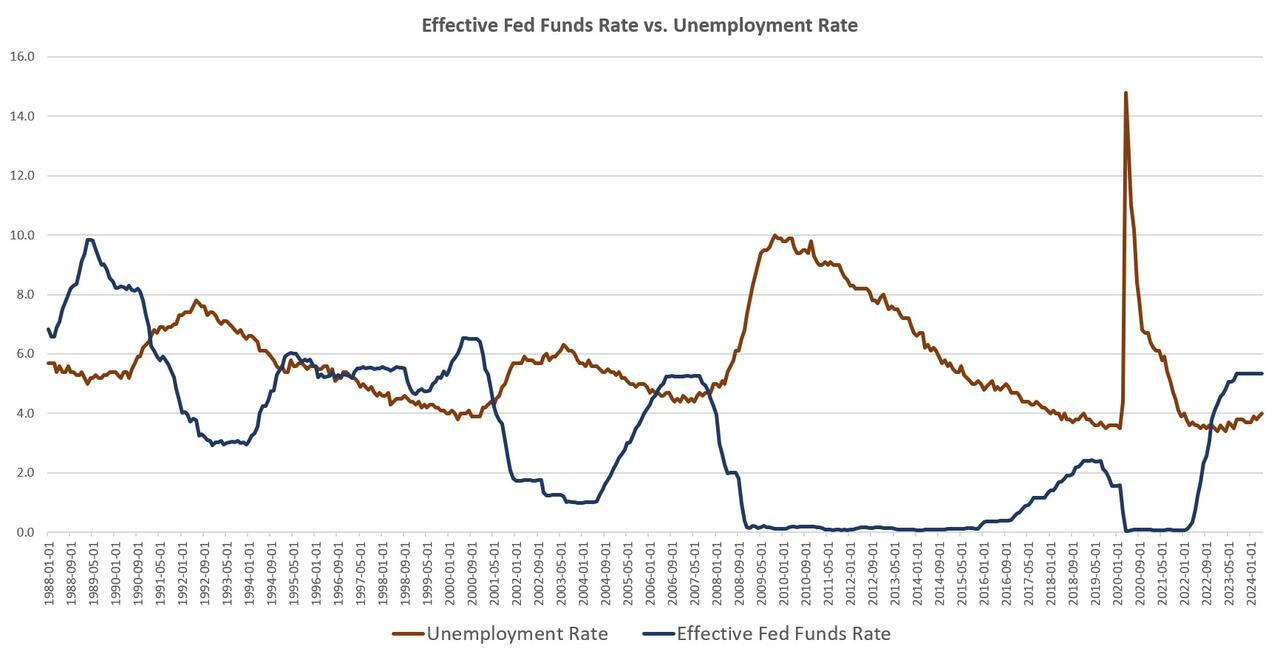

You might be surprised to learn the Fed has never actually managed to pull off a "soft landing" in the last several decades.

Tell me if you can spot the trend:

Last edited:

Wall Street is not Main Street and while the economics have some overlap and while there are some warning signs, what happened that day was a little more complicated when you factor in carry trades and the doom and gloom crowd claiming they were absolutely sure that was the beginning of the end. Yet, my QQQ is still up nearly 3% in the week since then.Indeed. But the tech sector is what's driving the stock market - the so called Magnificent 7 - and why we just had one of the worst few days on record since Black Monday. The Fed are just flying by wire, which is why the dot plot changes pretty much from one week to the next. They're really just making it up as they go, imo. Jerome Powell isn't even an economist. He's a lawyer for god's sake.

What sector is your business in?

Ok, I have to go pick things up and put them down. Good discussion.

- Joined

- Nov 6, 2022

- Messages

- 339

Well the carry trade is far from over. But you can see the risk is skewed heavily to the downside. As soon as leaks are detected, the rats go scurrying. I don't own any QQQ, but I made a nice chunk of change on SPY vertical put spreads, and will continue to do so until the sh*t really hits the fan, at which point that small chunk of change will turn into a small fortune.Wall Street is not Main Street and while the economics have some overlap and while there are some warning signs, what happened that day was a little more complicated when you factor in carry trades and the doom and gloom crowd claiming they were absolutely sure that was the beginning of the end. Yet, my QQQ is still up nearly 3% in the week since then.

Ok, I have to go pick things up and put them down. Good discussion.

And yet that is exactly what we are experiencing. The inverted yield curve is often viewed by Economists as an indicator of potential recession, the economy today remains resilient.Except for that whole inverted yield curve thing.

You might be surprised to learn the Fed has never actually managed to pull off a "soft landing" in the last several decades.

Tell me if you can spot the trend:

Gotta LOVE META.... once a dog is now officially a new standard... stay tuned, the multi-year run that is taking place is only the beginning... (but dont listen to me) If I get another chance at another dip Im might bail out of NVDA and pick up more of this, I just cant see anything stopping them or any type of competition that can hurt them which is very unique.

I mean, they are the premier world wide platform that every man, woman and child in world can access and FB sell advertising.

Im convinced their success is unstoppable... and there is NO WAY I am going to change my mind about that today or this week.

Dont ask me about next week though.

I just dont see how they can fail. It's a free product that the pubic uses like nothing else in the history of the world and companies PAY to advertise on. Go figure if that isnt a successful business I dont know what is..

I mean, they are the premier world wide platform that every man, woman and child in world can access and FB sell advertising.

Im convinced their success is unstoppable... and there is NO WAY I am going to change my mind about that today or this week.

Dont ask me about next week though.

I just dont see how they can fail. It's a free product that the pubic uses like nothing else in the history of the world and companies PAY to advertise on. Go figure if that isnt a successful business I dont know what is..

Last edited:

- Joined

- Nov 6, 2022

- Messages

- 339

Spot the pattern yet? Right now, we're in the early stages of a substantially weakening economy, which the Fed will attempt to preempt by slashing rates, in hopes of blowing a whole new bubble. This is what they're calling a "soft landing", but is really just pre-recession posturing. We never really recovered from 2008.And yet that is exactly what we are experiencing. The inverted yield curve is often viewed by Economists as an indicator of potential recession, the economy today remains resilient.

In simple terms, the Business Cycle.

In more Economic terms, the Business Cycle.

Last edited:

Similar threads

- Replies

- 23

- Views

- 1K

- Replies

- 67

- Views

- 2K

- Replies

- 29

- Views

- 1K