4WD

$50 site donor 2024

Nope. You don't understand oil markets. Oil is a global commodity so the price paid is the global price not the domestic vs international price.

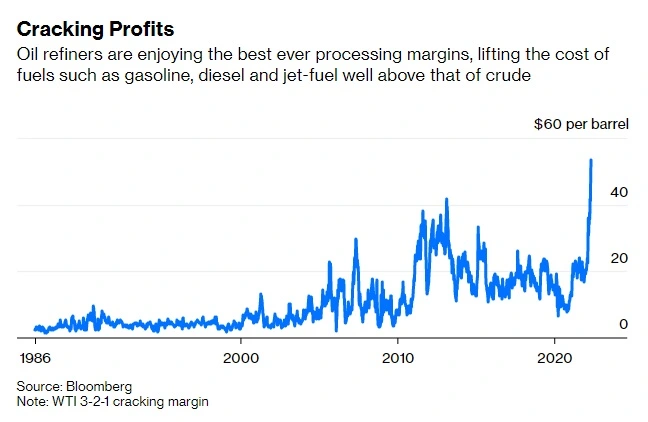

US oil production is still near all time highs. What has changed in the crack spread. The crack spread is the profit refineries earn when they refine oil into gas/diesel. It's ~3x higher than historical norms for Gas/Diesel. A lot of this fuel is being shipped to the EU.

Another thing is that oil drilling is capital intensive and domestic producers need higher prices to make it profitable.

The hydraulic stimulation phase (aka frack) is more expensive than the drilling phase …

Advantage ME where the completed wells don’t need stimulation …