I find it interesting that used 2017 base model Corvettes are selling for over the sticker price and well over the actual new selling price.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Will the used car market cool off?

- Thread starter dja4260

- Start date

In the long run auto market will not be the same as housing, because you can move cars around but cannot move the land a house is on around (thus your job, your family, your weather, your community, etc). You can even ship a used car from US to Africa and import a car from Japan to US, but you cannot do that with a house.

If anything, I think the market will go "upscale" in the future instead of selling loss leaders like before. Basically, you have to buy the mid to top trims because they won't sell you the bottom trim for a good deal.

I suspect we will end up having 7-10 year loan as the common way of life with warranty extended to those length as a condition to the loan term. When there's money to be made they will do it of course, and you will eventually pay for it too. The side effect will be when the equation balance out, we will get rid of some really horrible designs that won't last 7-10 years (i.e. Jatco CVT, air cooled EV battery, etc).

With vehicle age still creeping up, why not a 7 year loan? Apparently vehicles are retaining value all the longer. [No I don't want to tote the note for 7 years and I can see all the bad things that could happen, sub-prime borrowing etc, just saying, if it retains value for that long, why not? a mortgage is 30 years these days, which is longer than many roofs will last, right?] It is an interesting thought, if they bring back a 10 year warranty that is say 120k, or maybe better yet, 150k, then you're right, maybe some of the stupid stuff would go away.

I don't think all vehicles would qualify, likely only those cream puffs that last a long time and retain values (Camry, F150, Sienna, etc but not sub compact like Aveo or Mirage). To do that they need to have "insurance" companies willing to write warranty / guarantee contracts for that 7-10 year loans.With vehicle age still creeping up, why not a 7 year loan? Apparently vehicles are retaining value all the longer. [No I don't want to tote the note for 7 years and I can see all the bad things that could happen, sub-prime borrowing etc, just saying, if it retains value for that long, why not? a mortgage is 30 years these days, which is longer than many roofs will last, right?] It is an interesting thought, if they bring back a 10 year warranty that is say 120k, or maybe better yet, 150k, then you're right, maybe some of the stupid stuff would go away.

D

Deleted member 89374

You can still buy a new, or used, Hyundai for a reasonable price. Hyundai FTW!I don't think all vehicles would qualify, likely only those cream puffs that last a long time and retain values (Camry, F150, Sienna, etc but not sub compact like Aveo or Mirage). To do that they need to have "insurance" companies willing to write warranty / guarantee contracts for that 7-10 year loans.

Easy financing causes higher prices in cars, homes, college tuition, ect.With vehicle age still creeping up, why not a 7 year loan?

If they made people put 25% down and strict underwriting on new car loans the industry would be knocked down a few pegs.

Stated income and a fico score=your approved for a car.

Under writings for homes right now is very strict. It's the low interest rates and not enough inventory fueling the market. Also-unless you are in the 700 FICO range forget about favorable interest rates for a vehicle.Easy financing causes higher prices in cars, homes, college tuition, ect.

If they made people put 25% down and strict underwriting on new car loans the industry would be knocked down a few pegs.

Stated income and a fico score=your approved for a car.

Yea-I know somebody's 2nd cousins friend is an exception........to what I just stated.

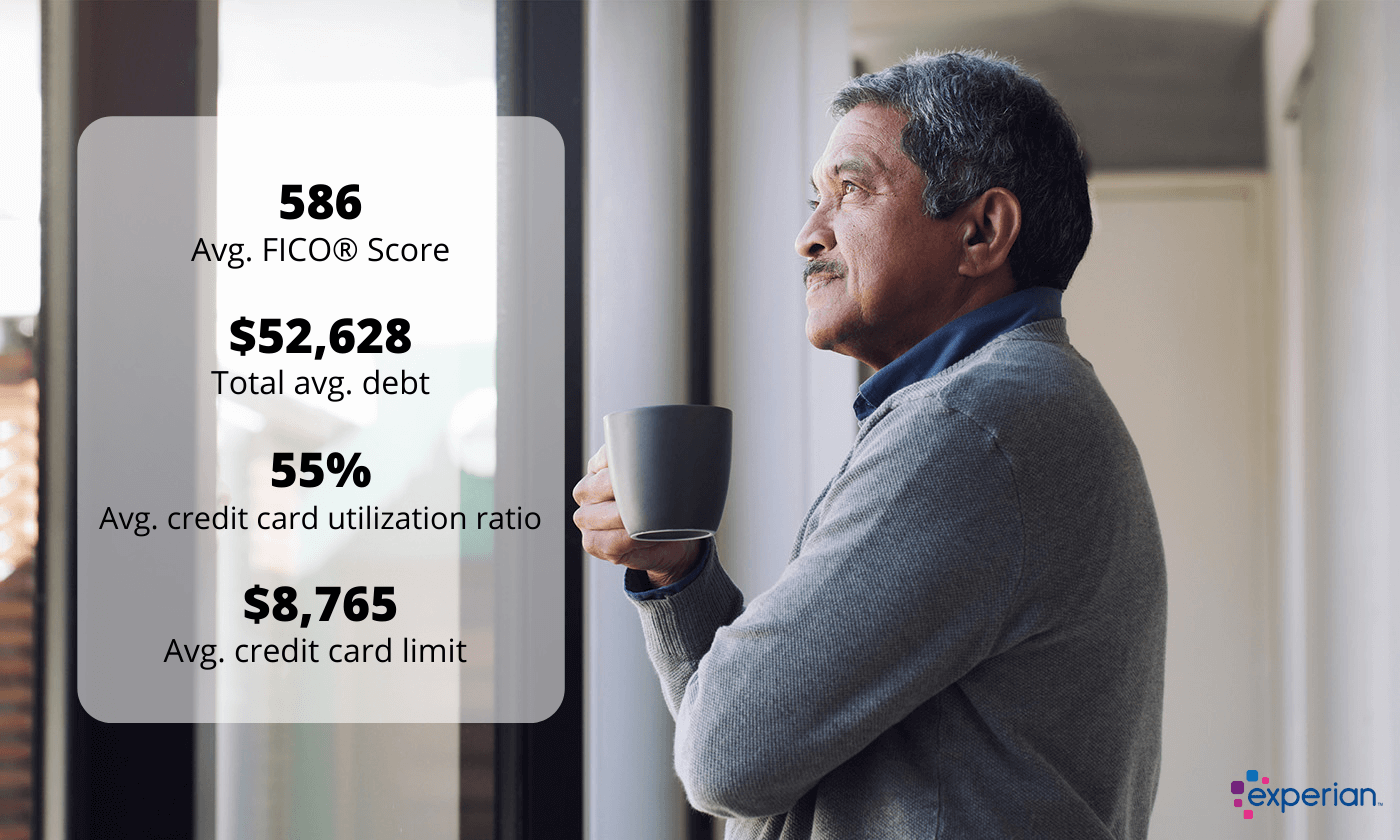

quote-In the U.S., nearly 1 in 3 consumers have a subprime score—but this population has shrunk by 12% since 2020, according to Experian data. Among the consumers who have subprime scores, many improved aspects of their credit over the past year.

Fewer Subprime Consumers Across U.S. in 2021

Nearly 1 in 3 Americans have a subprime credit score, according to Experian data. Down 12% nationally in 2021, with declines across all states.

www.experian.com

Kinda makes me wonder though. I’ve heard some automakers possibly lowering production of some stuff overall- so that discounts will not be needed. That, and it makes a quicker transition to EV…..Just hoping that by next summer, things cool down. I am content, until then. Should give enough time for the supply chain to get back to near-normal.

D

Deleted member 89374

The US economy has been shifting for a while now from massive production and consumption to less stuff for more money.Kinda makes me wonder though. I’ve heard some automakers possibly lowering production of some stuff overall- so that discounts will not be needed. That, and it makes a quicker transition to EV…..

From what I have seen in this area, home buyers are more qualified than ever before. They are often higher income individuals. I honestly do not expect to see any fall out this time.Easy financing causes higher prices in cars, homes, college tuition, ect.

If they made people put 25% down and strict underwriting on new car loans the industry would be knocked down a few pegs.

Stated income and a fico score=your approved for a car.

Used-vehicle prices have been higher than they would otherwise have been since the federal Cash for Clunkers program in 2009. Some states, particularly California, have had their own versions since.

When I was trying to find a good old-style Ford Ranger, I was seeing the prices creep up over time late last year and this year. Examples of 2005–2011 models with severe frame rust (bad news for Rangers) or obvious abuse and neglect were going for $10K+ by spring. Two really nice-looking ones on Craigslist were sold as I was on the road to look at them.

I had cash, but it became obvious that I was going to have to finance one that met my requirements. Finally got really lucky with the 2011 I bought in late April, which had been undercoated and rustproofed and well cared for. It was a trade-in at a new-car dealer. Finding another one like it would be nearly impossible now, and interest rates for financing are going to go up anyway. That's happening with new cars. We had a recent thread mentioning that Ford was quoting over 8% on longer-term car loans.

Those longer-term loans bother me. If you're going to buy a new gasoline or diesel vehicle with a 10–year note, I wonder about the price and availability of gas and diesel in 2031. No one thinks about that. We should.

When I was trying to find a good old-style Ford Ranger, I was seeing the prices creep up over time late last year and this year. Examples of 2005–2011 models with severe frame rust (bad news for Rangers) or obvious abuse and neglect were going for $10K+ by spring. Two really nice-looking ones on Craigslist were sold as I was on the road to look at them.

I had cash, but it became obvious that I was going to have to finance one that met my requirements. Finally got really lucky with the 2011 I bought in late April, which had been undercoated and rustproofed and well cared for. It was a trade-in at a new-car dealer. Finding another one like it would be nearly impossible now, and interest rates for financing are going to go up anyway. That's happening with new cars. We had a recent thread mentioning that Ford was quoting over 8% on longer-term car loans.

Those longer-term loans bother me. If you're going to buy a new gasoline or diesel vehicle with a 10–year note, I wonder about the price and availability of gas and diesel in 2031. No one thinks about that. We should.

If you want to buy new, check Mazda dealers. Some of them still seem to have inventory of new vehicles. So far, that company still has incentives or lower interest-rate offers for certain new models.

Qualifying for a mortgage today has changed a little today compared to 10 yrs ago. Gains in the stock market combined with low rates have really juiced prices. More and more people are taking out loans on their 401k or selling stock for down payments. There's also a plethora of govt down payment assistance where states and cities offer a few thousand dollars in a forgivable second lien.From what I have seen in this area, home buyers are more qualified than ever before. They are often higher income individuals. I honestly do not expect to see any fall out this time.

6-8 years auto loans have been a fixture for almost a decade. It gave automakers the ability to increase prices almost at will. Unfortunately the longer terms discourage people from selling because they're upside down and the vehicles last longer.Used-vehicle prices have been higher than they would otherwise have been since the federal Cash for Clunkers program in 2009. Some states, particularly California, have had their own versions since.

When I was trying to find a good old-style Ford Ranger, I was seeing the prices creep up over time late last year and this year. Examples of 2005–2011 models with severe frame rust (bad news for Rangers) or obvious abuse and neglect were going for $10K+ by spring. Two really nice-looking ones on Craigslist were sold as I was on the road to look at them.

I had cash, but it became obvious that I was going to have to finance one that met my requirements. Finally got really lucky with the 2011 I bought in late April, which had been undercoated and rustproofed and well cared for. It was a trade-in at a new-car dealer. Finding another one like it would be nearly impossible now, and interest rates for financing are going to go up anyway. That's happening with new cars. We had a recent thread mentioning that Ford was quoting over 8% on longer-term car loans.

Those longer-term loans bother me. If you're going to buy a new gasoline or diesel vehicle with a 10–year note, I wonder about the price and availability of gas and diesel in 2031. No one thinks about that. We should.

A large dealer owner is a host of a auto show on talk radio I listen to on Saturdays. He stated certain used vehicles that get traded in are worth more outside of the USA, go to auction and get exported. Older Camry’s and Corollas in particular.

I'm old enough to remember when the government was paying taxpayer money for dealers to buy good, used cars, trucks, and vans... with the end result of destroying them.

Some of us thought that was a horrendous idea at the time. Some of us still do.

Some of us thought that was a horrendous idea at the time. Some of us still do.

True, but in our area, buyers in the $1-$1.5M bracket have solid down payments and employment. $200-$400k down is typical, so I do not see these transactions going sour in the same manner.Qualifying for a mortgage today has changed a little today compared to 10 yrs ago. Gains in the stock market combined with low rates have really juiced prices. More and more people are taking out loans on their 401k or selling stock for down payments. There's also a plethora of govt down payment assistance where states and cities offer a few thousand dollars in a forgivable second lien.

Your problem is that the market for California real estate truly is global. All those USD from Asia flooding your market.True, but in our area, buyers in the $1-$1.5M bracket have solid down payments and employment. $200-$400k down is typical, so I do not see these transactions going sour in the same manner.

I think that depends on the area. All of the homes in my zipcode are being sold to actual families, some of them are ones that have been outbid in silicon valley.Your problem is that the market for California real estate truly is global. All those USD from Asia flooding your market.

True, but in our area, buyers in the $1-$1.5M bracket have solid down payments and employment. $200-$400k down is typical, so I do not see these transactions going sour in the same manner.

Yes, the $1 - 1.5M market is typical of the US.

Similar threads

- Replies

- 12

- Views

- 1K

- Replies

- 103

- Views

- 8K