You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How much are you paying for Homeowner's insurance?

- Thread starter stockrex

- Start date

$1960 yearly for a $400k valuation and $2500 deductible. 0 claims, but in the Wildland Urban Interface Zone.

Home value - $200k

Deductible - $1k

Premium - $925/yr

Deductible - $1k

Premium - $925/yr

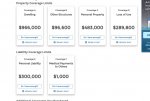

Coverage A- $750K

Deductible - $2500

Cov-A Cash-out option, 200% Additional Replacement Cost (if-needed), Ord or Law up to the Cov-A limit, Water Back-Up of Sewers and Drains up to the Cov-A limit.

$1500/yr.

Deductible - $2500

Cov-A Cash-out option, 200% Additional Replacement Cost (if-needed), Ord or Law up to the Cov-A limit, Water Back-Up of Sewers and Drains up to the Cov-A limit.

$1500/yr.

Value $220K or full replacement cost

Deductible $500

Premium $589

Policy includes $25K for legal defense of defending the home with lethal force from forced intrusion

Covers all under ground utilities and major appliances like the AC and Furnace if they need replaced.

Local ordinances require camera views of the outflow waste water pipes when the home is put up for sale.

If repairs are needed on said pipes the policy covers it.

I can't remember everything listed they cover but the above alone is worth it just with the underground utility coverage.

BTW it's from Erie Ins called Home Secure policy.

I think it's a Pa. only policy but if you're in a neighboring state you might want to check on it.

Deductible $500

Premium $589

Policy includes $25K for legal defense of defending the home with lethal force from forced intrusion

Covers all under ground utilities and major appliances like the AC and Furnace if they need replaced.

Local ordinances require camera views of the outflow waste water pipes when the home is put up for sale.

If repairs are needed on said pipes the policy covers it.

I can't remember everything listed they cover but the above alone is worth it just with the underground utility coverage.

BTW it's from Erie Ins called Home Secure policy.

I think it's a Pa. only policy but if you're in a neighboring state you might want to check on it.

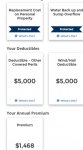

Coverage A: 320k

deductible: 1000

$650/year

deductible: 1000

$650/year

What company ? Many will enter a state and give everyone super low rates (almost a loss leader or a way to generate a lot of new business) and then after a few years, raise them to their "regular" rates. Plenty of consumers complain about it, post about it on the internet, but do nothing else. They just pay the increased amount....it was around $440 and then bammm, big jump here in MI.

Value $220K or full replacement cost

Deductible $500

Premium $589

Policy includes $25K for legal defense of defending the home with lethal force from forced intrusion

Covers all under ground utilities and major appliances like the AC and Furnace if they need replaced.

Local ordinances require camera views of the outflow waste water pipes when the home is put up for sale.

If repairs are needed on said pipes the policy covers it.

I can't remember everything listed they cover but the above alone is worth it just with the underground utility coverage.

BTW it's from Erie Ins called Home Secure policy.

I think it's a Pa. only policy but if you're in a neighboring state you might want to check on it.

I have the same policy in Ohio.

Value: $211.5K or full replacement cost

$42.3K coverage for other structures

$158,625 Personal Property

$10K Sewer/Drain Rider

$3.3K Additional Jewelry Rider

$25K Identity Theft

$500. Deductible

$835./yr

$1M Umbrella $334./yr

Home value 180K

1k deductible

2400 yr. Nebraska hail and wind is a ***** on roofs.

1k deductible

2400 yr. Nebraska hail and wind is a ***** on roofs.

Zee09

$200 Site Donor 2023

What company ? Many will enter a state and give everyone super low rates (almost a loss leader or a way to generate a lot of new business) and then after a few years, raise them to their "regular" rates. Plenty of consumers complain about it, post about it on the internet, but do nothing else. They just pay the increased amount....

Absolutely true- I float around every two years on my houses and always get a $5000. deductible

Rates in my case can double overnight. I have floated between 4 companies for the last 20 years.

As you say you get the intro rate and then BAM!!!!!!!!!!!

- Joined

- Dec 28, 2011

- Messages

- 5,058

Absolutely true- I float around every two years on my houses and always get a $5000. deductible

Rates in my case can double overnight. I have floated between 4 companies for the last 20 years.

As you say you get the intro rate and then BAM!!!!!!!!!!!

+1

Additionally if a larger insurance company takes a big hit (think state Farm IIRC after Katrina) they raised all types of insurance rates all over the country to help with the pay-out. What often happens in my area (NY) is that you will get a sweetheart rate for 2 years and renewals slowly inch upwards enough that within 5 years you notice and leave for the next guy!

$600k

$864 ($72 month for homeowners. Includes 1 Million umbrella coverage. 2k Deductible).

We take a hell of a hit in car insurance here in New Yorkistan. Nothing on my driving record, and low crime area where garaged. $2600 a year for 17 Subaru and 15 F150. After the riots I can only imagine what the rates are in some of the cities that saw the worst.

Zee09

$200 Site Donor 2023

OVERKILL

$100 Site Donor 2021

Value: $550K

Cost: $138/month (taxes in) so $1,656/year

Deductible: $500

This includes coverage of specific valuables like expensive rifles, which I had to document and provide serial #'s for.

I have my auto and ATV policy through the same company.

Cost: $138/month (taxes in) so $1,656/year

Deductible: $500

This includes coverage of specific valuables like expensive rifles, which I had to document and provide serial #'s for.

I have my auto and ATV policy through the same company.

Zee09

$200 Site Donor 2023

Value: $550K

Cost: $138/month (taxes in) so $1,656/year

Deductible: $500

This includes coverage of specific valuables like expensive rifles, which I had to document and provide serial #'s for.

I have my auto and ATV policy through the same company.

Being in the gun business you can get cheap insurance for your guns through private carriers where you do not have

to supply serial numbers. You can get $300K USD insurance for not a bunch of money

Doesn't matter if you are an individual or a dealer.

OVERKILL

$100 Site Donor 2021

Being in the gun business you can get cheap insurance for your guns through private carriers where you do not have

to supply serial numbers. You can get $300K USD insurance for not a bunch of money

Doesn't matter if you are an individual or a dealer.

May be different here in Canada. There wasn't any additional surcharge to add the guns, but to have them and their value covered, there needed to be documentation of what they were, like my CDX-33.

Does it vary by state, because in Ohio, we have coverage for the physical house itself (full replacement cost, i.e. pays to "rebuild" the same structure) as well as coverage for contents.

And this question is for my own curiosity, but how much impact does the deductible have on the premium ? With auto coverage (granted, the "property" value is generally much, much lower), changing from a $500 deductible to $1000 has a minimal impact.

And this question is for my own curiosity, but how much impact does the deductible have on the premium ? With auto coverage (granted, the "property" value is generally much, much lower), changing from a $500 deductible to $1000 has a minimal impact.

OVERKILL

$100 Site Donor 2021

Does it vary by state, because in Ohio, we have coverage for the physical house itself (full replacement cost, i.e. pays to "rebuild" the same structure) as well as coverage for contents.

And this question is for my own curiosity, but how much impact does the deductible have on the premium ? With auto coverage (granted, the "property" value is generally much, much lower), changing from a $500 deductible to $1000 has a minimal impact.

Mine is both contents and structure, it's inclusive.

Zee09

$200 Site Donor 2023

Does it vary by state, because in Ohio, we have coverage for the physical house itself (full replacement cost, i.e. pays to "rebuild" the same structure) as well as coverage for contents.

And this question is for my own curiosity, but how much impact does the deductible have on the premium ? With auto coverage (granted, the "property" value is generally much, much lower), changing from a $500 deductible to $1000 has a minimal impact.

The impact is large when you go to $5K deductible

I figure I will fix the small stuff myself. As we all know claims raise your rates.

I want insurance for a total loss or big hit- not for some small $$$ issues.

Similar threads

- Replies

- 33

- Views

- 1K

- Replies

- 83

- Views

- 3K

- Replies

- 68

- Views

- 3K